- Home

- ArthNivesh

- Finance Forum

- Samnidhy

- TJEF

- Finance Lab

Top Insights

Home Finance at TAPMI

Top News

Finomenal

13 June 2016

FINO-GRAPHIC #4: INDIA’S NPA SCENARIO

25 June 2018

Company Analysis of Infosys Ltd.

27 January 2023

Budget Analysis 2023: EDUCATION

6 February 2023

Should emerging markets worry about the US monetary policy announcements?

9 March 2022

Volume 06: Issue 51

21 November 2023

Sunday ArticlesTJEF

Wondering why we haven’t covered the Sahara Desert with solar panels yet?

ByTJEF Tapmi10 March 2024

BlogSunday ArticlesTJEF

Navigating the Waters of Global Trade: Understanding the World Trade Organization and India’s Stand on Investment Facilitation

ByTJEF Tapmi3 March 2024

Sunday ArticlesTJEF

The EV revolution to a greener planet

ByTJEF Tapmi25 February 2024

BlogSunday ArticlesTJEF

Do we still need Credit Cards?

ByTJEF Tapmi18 February 2024

From TJEF

Volume 1, Issue 5

March 2017 Issue, Volume 1, Issue No.5 In the year 2016 – 17, we all have witnessed “Black Swan” events such as Demonetization…

ByTJEF Tapmi19 March 2024

TJEF Journals

Volume 1, Issue 4

19 March 2024

TJEF Journals

Volume 1, Issue 3

19 March 2024

TJEF Journals

Volume 1, Issue 2

19 March 2024

TJEF Journals

Volume 1, Issue 1

18 March 2024

From Samnidhy

SamnidhySamnidhy | Weekly Newsletters

Volume 06 : Issue 60

BySamnidhy22 January 2024

Company Analysis of EID Parry

EID Parry is the first Indian private sector company to engage in research anddevelopment. It established India’s first sugar plant at Nellikuppam in…

BySamnidhy19 January 2024

Samnidhy | Company Analysis

Company Analysis of Dr Reddy

15 January 2024

SamnidhySamnidhy | Weekly Newsletters

Volume 06 : Issue 59

15 January 2024

SamnidhySamnidhy | Weekly Newsletters

Volume 06: Issue 58

8 January 2024

Samnidhy | Company Analysis

Company Analysis of ZF Commercial

8 January 2024

SamnidhySamnidhy | Weekly Newsletters

Volume 06: Issue 56

26 December 2023

Samnidhy | Company Analysis

Company Analysis of Wipro Limited.

25 December 2023

From ArthNivesh

Volume 15: Issue 3

Investors typically purchase assets like stocks, bonds, real estate, or business ventures in the hope that their value will appreciate over time. Investment…

ByArthNivesh12 October 2023

ArthNivesh | Newsletter

Volume 9: Issue 13

11 October 2023

ArthNivesh | Newsletter

A₹thNivesh Newsletter: Issue 19

3 August 2023

ArthNivesh | Newsletter

ArthNivesh Newsletter: Issue 15

9 June 2023

ArthNivesh | Newsletter

ArthNivesh Newsletter: Issue 14

6 June 2023

Explore More

Company Analysis of Gujarat Fluorochemicals

Company Analysis Campus Gujarat Fluorochemicals Limited (GFL) is an Indian company specializing in Fluorine Chemistry for over 30 years. GFL excels in Fluoropolymers,…

BySamnidhy11 December 2023

BlogSunday ArticlesTJEF

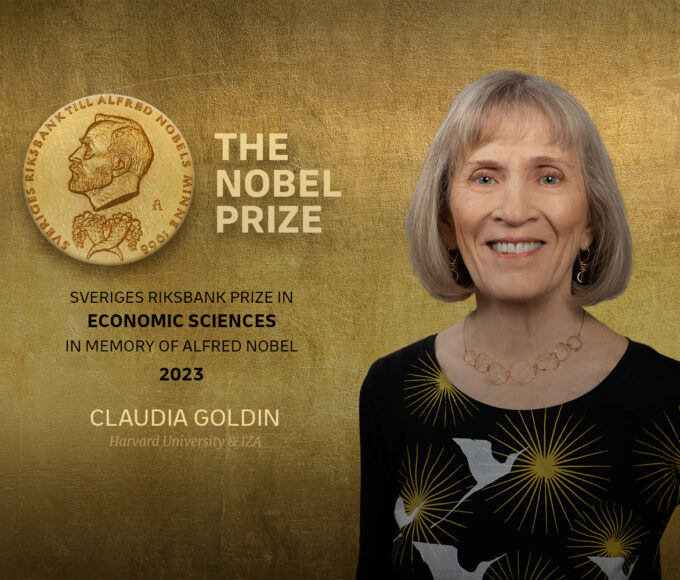

Unlocking the Gender Disparities in Workforce: Claudia Goldin’s Insightful Perspective

Editor – Mugilganesh RM On October 9, 2023, Claudia Goldin, a Harvard University professor and economic historian, became the third woman to win…

ByTJEF Tapmi10 December 2023

Company Analysis of Larsen & Toubro

Company Analysis Campus Larsen & Toubro is one the largest companies in the private sector of India. It has been in business for…

BySamnidhy4 December 2023

Sunday ArticlesTJEF

Can Money Buy Happiness? The Economic Pursuit of Joy

Editor – Sowmika Konduru Introduction In the relentless pursuit of happiness, humanity has often looked to the tangible, the measurable, the external. Money…

ByTJEF Tapmi3 December 2023

Company Analysis of Campus

Company Analysis Campus Launched in 2005, Campus is a lifestyle-focused sports and athleisure brand providing a varied product range for the entire family….

BySamnidhy27 November 2023

BlogSunday ArticlesTJEF

Can you buy Space in Space?

Editor – Swetha Jaya Consider negotiating property boundaries with adjacent black holes or dealing with anti-gravity garden zoning rules. Maybe one day there…

ByTJEF Tapmi26 November 2023

Trending Now

India’s Summer Olympic Odyssey: Unveiling the Economic Horizons of the 2036 Bid”

-Editor -Chourasia Anshul Why In the news? The recently concluded 141st International Olympic Committee session was held at Jio World Center in Mumbai…

ByTJEF Tapmi22 October 2023

Sunday Articles

Middle East Mayhem

The Palestinian militant group Hamas launched an unprecedented assault on Israel on Saturday, with hundreds of gunmen infiltrating communities near the Gaza Strip….

ByTJEF Tapmi15 October 2023

Sunday Articles

JOBLESS GROWTH: India’s wake up call for inclusive development

When analyzing the recent growth achievements of many nations, particularly India, the argument that the wealthy are growing richer, and the poor are…

ByTJEF Tapmi15 October 2023

Sunday Articles

Leveraging Machine Learning for Predicting Market movements using Historical Data

Abstract Due to the complexity and volatility of financial markets, predicting stock market movements has always been a difficult endeavour. The purpose of…

ByTJEF Tapmi3 September 2023

Trending Topics

Explore the best news this week

Finance Forum8 Articles

Finance Forum8 Articles Samnidhy64 Articles

Samnidhy64 Articles TJEF23 Articles

TJEF23 Articles ArthNivesh2 Articles

ArthNivesh2 Articles

Editor’s picks

Company Analysis of Tata Consumer Products Limited

Tata Consumer Products Limited, part of the esteemed Tata Group, originated from the merger of Tata Global Beverages and Tata Chemicals’ consumer business…

BySamnidhy29 January 2024

SamnidhySamnidhy | Weekly Newsletters

Volume 06 : Issue 61

29 January 2024

BlogThoughtful TuesdaysTJEF

Ayodhya’s Growth Story: From Temple to Tourism Hub

23 January 2024

SamnidhySamnidhy | Weekly Newsletters

Volume 06 : Issue 60

22 January 2024

Sunday ArticlesTJEF

Behind the Frontlines: Unveiling the Economics of War and Its Global Ramifications

21 January 2024

Latest News

Company Analysis of EID Parry

EID Parry is the first Indian private sector company to engage in research anddevelopment. It established India’s first sugar plant at Nellikuppam in…

BySamnidhy19 January 2024

BlogThoughtful TuesdaysTJEF

Droplets to Dollars: Australia’s Aquatic Adventure

Editor – Swetha TM In the heart of Australia’s sun-drenched landscape, where the Murray River winds its way through ancient red sands, a…

ByTJEF Tapmi16 January 2024

Company Analysis of Dr Reddy

Established in 1984, Dr. Reddy’s Laboratories is dedicated to the purpose of “Good Health Can’t Wait”. Operating globally, thecompany specializes in active pharmaceutical…

BySamnidhy15 January 2024

Volume 06 : Issue 59

BySamnidhy15 January 2024

Sunday ArticlesTJEF

COP 28 & the India climate agenda

Editor – Sai Janani The COP28 convened in Dubai, UAE, from 30 Nov to 13 Dec 2023. More than 85,000 participants, including 150…

ByTJEF Tapmi14 January 2024

TAPMI BLOOMBERG OLYMPIAD 2023

ByFinance Forum13 January 2024

ArthNiveshArthNivesh | Newsletter

ArthNivesh Newsletter V3, Issue 24

The newsletter covers insights about litigation financing, its purpose, arrangement, and beneficiaries. This file aims to provide clarity on these important financial matters.How…

ByArthNivesh12 January 2024

BlogThoughtful TuesdaysTJEF

Spirits of India: Decoding the Alcohol Economy

Editor – Ankita Kumari *Disclaimer: Before delving into the intricate details of India’s alcohol economics, it’s imperative to acknowledge that excessive alcohol consumption…

ByTJEF Tapmi9 January 2024

load more

Recommended

Behind the Frontlines: Unveiling the Economics of War and Its Global Ramifications

By TJEF Tapmi21 January 2024

BlogThoughtful TuesdaysTJEF

Droplets to Dollars: Australia’s Aquatic Adventure

16 January 2024

Sunday ArticlesTJEF

COP 28 & the India climate agenda

14 January 2024

BlogThoughtful TuesdaysTJEF

Spirits of India: Decoding the Alcohol Economy

Recent Posts

Categories

Categories

- ArthNivesh53

- ArthNivesh | Events6

- ArthNivesh | Newsletter59

- Blog261

- Budget 20188

- Budget 20196

- Budget 20203

- Budget 20216

- Budget 20237

- Finance Forum5

- Finance Forum | M&A2

- Finance Forum | M&A3

- Finance Forum Events1

- FNS1

- Manthan3

- Samnidhy64

- Samnidhy | Company Analysis40

- Samnidhy | Weekly Newsletters66

- Sunday Articles63

- Thoughtful Tuesdays24

- TJEF70

- TJEF Journals23