Editor – Sai Janani ||

Global automobile & car sales are about 80 million cars valued at $4.3 trillion, with 450+ businesses, employing nearly 6 million people. The industry has a huge impact on the environment with both manufacturing and fuel consumption.

From 2035, automobiles can no longer be fitted with Internal Combustion Engines (ICE), as the world is progressing towards a Net Zero Emissions (NZE) scenario by 2050. Electric Vehicles (EV) inventory of vehicles will reach 350 million vehicles by 2030. At the same time, a lot of work remains in diversifying production of EV batteries manufacturing and in ensuring continued supply of critical raw materials required for manufacturing EV components and batteries.

Global warming, Greenhouse Gas (GHG) emissions, and the resulting climate events, in the form of extreme weather calamities like the melting of polar glaciers, rising sea levels, and more frequent cyclones/typhoons, have become household events. Reducing fossil fuel consumption, thereby reducing GHG, hinges a lot on the success and faster adoption of EVs.

Electric car sales break new records with momentum expected to continue beyond 2023

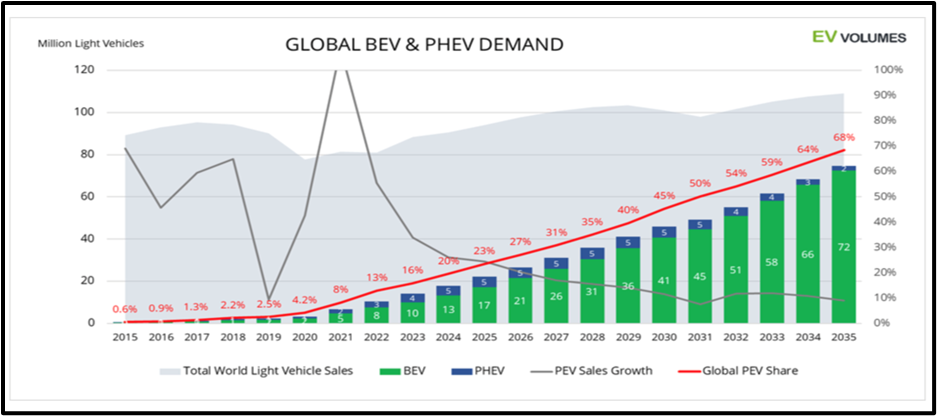

Global EV sales of battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) were around 14 million units in 2023, with a year-on-year (YoY) growth of 34%. EVs take a 16% share of the global market, with projections to reach about 23% in 2025, then 45% in 2030, and 68% in 2035.

China dominates this space with 60% of global electric car sales. China roads host more than 50% of EVs running on this planet and it exceeds its 2025 target for EV sales. Europe comes second with about 20% and the United States third at 8% EVs of total sales.

India: EV roadmap supported by Production Linked Incentives (PLI)

India is committed to EV30@30, a campaign that aims for electric vehicles (EVs) to account for at least 30 percent of new vehicle sales by 2030. With 49,800 EVs out of 3.8 million passenger vehicle sales in 2022, India has achieved just 1.3 percent.

In India, EV and component manufacturing is ramping up, supported by the government’s incentive programme for batteries, vehicles and components that has attracted investments.

PLI on Battery Storage was announced in 2021 to boost domestic battery manufacturing with a budget of USD 2.2 billion. The government targets 50 GWh in domestic manufacturing capacity with funds linked to sales of batteries manufactured in India and meeting a graded domestic value-add increasing to 60% in year 5. While ambitious, with no significant domestic battery cell manufacturing in India, the scheme attracted 10 bids with a cumulative capacity of 128 GWh in early 2022. The government sanctioned funds to 3 companies – Reliance, Ola, and Rajesh – for a total of at least 30 GWh of battery manufacturing capacity with the remainder to be allocated to the next highest-placed bidder(s). Furthermore, 95 GWh will come from other private companies.

PLI for Automobile OEM rewards sales of advanced automotive technology vehicles (battery electric and hydrogen fuel cell vehicles). For Component manufacturers, PLI applies to both ICE and electric vehicles. The budgetary outlay is USD 3.2 billion over five years, and the scheme has been successful in attracting investments of USD 8.3 billion, to be spent over five years. Domestic value addition in manufacturing requirements of 50% is the key qualifying criterion for both automobile and component PLIs.

EV boom sets off high-end tech hiring in India

Currently, India has around 400 EV manufacturers and an 11 million-strong workforce. EVs will provide 50 million direct and indirect jobs by 2030. Bengaluru has emerged as the primary hub for EV talent, accounting for nearly 59% of job postings. Seventy to eighty percent of the existing automotive-experienced workforce is transitioning into EV manufacturing. Only 15% to 25% new skills in electrical and electronics engineering are needed.

With the rapid growth in India’s EV sales, hiring local talent has earned great urgency for engineering skills in R&D, data science, mechanical, electronics, battery designing and robotics. Demand for talent employable by the EV industry has shot up exponentially, with a fivefold increase in recruitment.

Switch Mobility, the EV arm of Ashok Leyland, has a 550 member-team, of which 220 are in the R&D department. Switch is building a talent pipeline, bringing in freshers and Graduate Trainee Engineers (GTE) who will be groomed as “future-ready leaders”.

TVS Motor, which manufactures and sells 2 and 3-wheelers has employed 2,000 engineers in material science, electric powertrain, and data science while the EV battery assembly has 65% women. MG Motor India, another major player, has deployed 20% of people in the EV business, expecting steep growth in business.

In 2023, Tata Motors had 72 percent, MG Motors about 11 percent) and Mahindra 9 percent of the EV sales. Popular EV car models are Tiago, Nexon and Tigor from Tata Motors, the MG ZS, and Mahindra XUV400.

Big EV companies in India are working with academic institutions to develop appropriate curriculum, to be able to get talent with more readiness for the EV industry.

Landmark EV policies are driving the outlook for EVs closer to climate ambitions

The International Energy Agency (IEA) has announced a Stated Policies Scenario (STEPS), where EV share is targeted to be 35% of total automobile sales by 2030. China, US and Europe continue to hold the top 3 positions and will lead the charge to increase EV penetration, leading to positive outcomes for the environment.

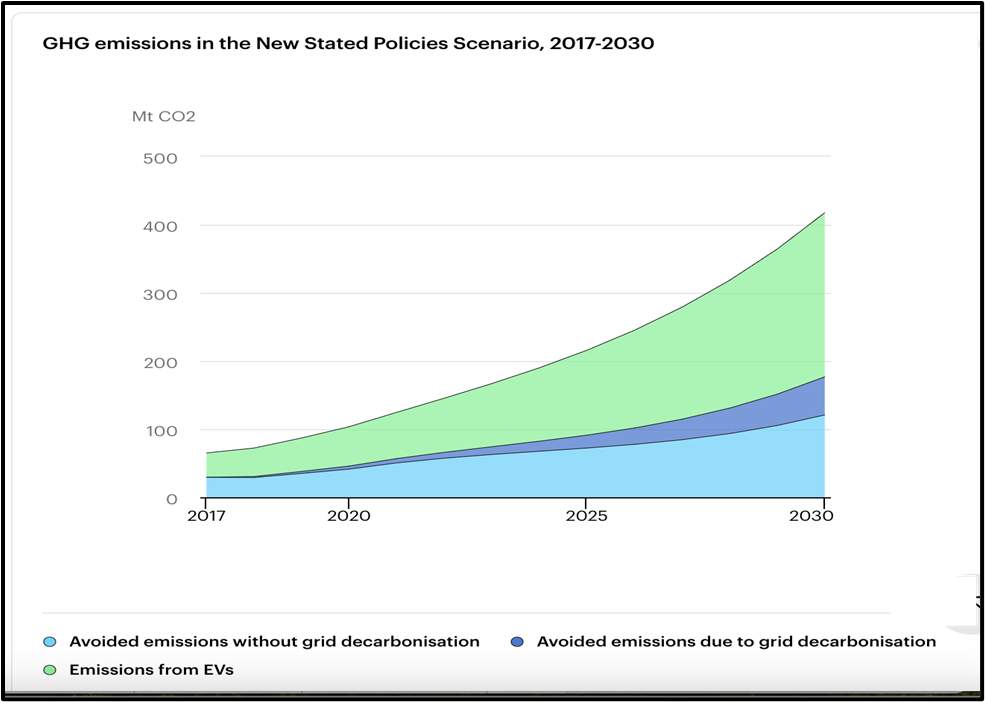

As below: Progression of GHG emission (Mt CO2) in the EV30@30 Scenario, 2017-2030

According to the U.S Department of Energy, the average annual emission of an electric vehicle is 1,278 kg of CO2, while for gasoline cars it’s over 4 times more – 5,712 kg of CO2.

Growth in demand for EVs will majorly influence energy markets and climate goals in the present energy policy scenario. Oil demand for road transport will peak in 2025 per STEPS, but by 2035 electric vehicles will replace 5 million barrels per day, which will arrest emissions by a CO2 equivalent of around 700 Mt.

The EU and US are moving forward rapidly with legislation to match their intent on adopting locomotive electrification. The new EU CO2 standards for cars and vans are aligned with their 2030 goals. In the United States, the Inflation Reduction Act (IRA) aims to achieve 50% market share for electric cars in 2030, with the US Environmental Protection Agency also moving in sync.

Battery manufacturing goes hand-in-hand with the forecast targets for EVs, with its capacity much ahead in meeting the demand for EVs towards Net Zero Emissions by 2050. It is possible to achieve even higher EV sales, purely based on battery manufacturing capacity.

As spending and competition increase, a growing number of more affordable models come to market

EV spending exceeded $425 billion in 2022, with a growth of 50% compared to 2021. This growth, though 10% attributable to government support, reflects consumers’ increasing switch to EVs as an environmentally friendly option. VC funds spent nearly USD 2.1 billion in 2022, up 30% from 2021, with investments attracted towards batteries and critical minerals.

SUVs being more than 60% of BEV options in China, US and Europe still contributed 80 Mt net emissions reductions, however ICE (Internal Combustion Engines) SUVs emitted over 1 Gt CO2 in 2022.

Battery electric SUVs have batteries that are about 2 to 4 times larger than small cars, requiring mining for more critical minerals. However, last year electric SUVs resulted in the displacement of over 150,000 barrels of oil consumption per day and avoided the emissions that would have been generated through burning the fuel in combustion engines.

Electric car options have doubled in 4 years till 2022 to almost five hundred models. India is showing the way with more affordable EV options, simply because of consumer preferences on cost considerations. Nearly 69% of all cars sold in India last year were priced below $15,000, 27% cost less than $10,000 and combustion-engine models like Suzuki’s Swift and Wagon R sell for less than $8,000. It is important not just to switch to EVs but also towards smaller capacity, smaller battery size options, so as to accelerate emission reductions.

It’s not just about cars but also about commercial vehicles, 2 & 3 wheelers

Energy goals go beyond cars. It is to be noted that 2 & 3 wheelers are the most electrified market segment today.

In emerging markets like India, they are more numerous than cars, with more than half of India’s three-wheeler registrations in 2022 being electric. The popularity is due to government incentives and lower lifecycle costs in a scenario of steep fuel price increases. Developing economies are also making their contribution, with more affordable vehicles moving towards electrification, leading the charge to sustainable development.

LCVs and HCVs are also seeing increasing electrification. Electric light commercial vehicle (LCV) sales worldwide increased by more than 90% in 2022 to more than 310,000 vehicles, even as overall LCV sales declined by nearly 15%. More than 60,000 electric buses and trucks are sold worldwide, contributing to 4.5% of all bus sales and 1.2% of truck sales. Populated urban cities are doing even better with the electrification of public transport, with Finland achieving 65% electric bus sales in 2022.

HCV electrification is moving at a fair pace, with around 220 models in the market, with over 800 models being offered by 100 OEMs. 27 countries are well on the way to 100% Zero Emission Vehicle bus and truck sales by 2040. The EU & US are also implementing stronger emissions standards for heavy-duty vehicles.

EV supply chains and batteries gain greater prominence in policy-making

The increase in demand for electric vehicles is also leading to increased mining for lithium, cobalt and 10% nickel used in EV batteries. The ratio of usage of the said minerals is 60/30/10. Industry and environment pundits are seriously looking at alternatives and efficient use of raw materials.

An alternative to lithium-ion is sodium-ion batteries, with 100 GWh of manufacturing capacity having come up, in China.

The EV supply chain needs to expand, given the over-dependence on China. It has a share of 35% of exported electric cars with Europe being China’s largest trade partner for both electric cars and their batteries.

EV supply chains are dominating the discussions around EV policy-making, both to minimize the mining for critical minerals and to diversify the dependence on a few countries. India is boosting its domestic manufacturing of electric vehicles and batteries through Production Linked Incentive (PLI) schemes. The US is actively implementing the Inflation Reduction Act by strengthening domestic supply chains for EVs, EV batteries, and battery minerals. Investment and incentives for local manufacturing are pouring in across the world.

The way forward: the Norway way

Norway leads in EV adoption: 82% of new car sales were EVs in Norway in 2023. In comparison, 7.6% of new car sales were electric in the U.S. last year. The Norwegian government started incentivizing the purchase of EVs back in the 1990s, but it wasn’t until Tesla and other EV models became available about ten years ago that sales really started to take off. Norway’s capital, Oslo, is also electrifying its ferries, buses, semi-trucks and even construction equipment. Gas pumps and parking meters are being replaced by chargers. It’s an electric utopia of the future.

To make EV chargers more accessible and affordable, urban planners, building developers, and electrical equipment suppliers must integrate charging infrastructure into standard building design plans.

References:

https://www.iea.org/reports/global-ev-outlook-2023

https://www.iea.org/reports/global-ev-outlook-2023/policy-developments

Times of India News Articles

Leave a comment