Editor – Ankita Kumari

*Disclaimer: Before delving into the intricate details of India’s alcohol economics, it’s imperative to acknowledge that excessive alcohol consumption can have adverse health effects. This article aims to provide an objective exploration of the economic factors influencing alcohol consumption in India, but it does not endorse or encourage alcohol consumption.

Alcohol Economics in India

In India, known for its love of tea and passion for yoga, alcohol consumption is quite interesting. Even though these traditional practices are popular, about 112 million people in India enjoy drinking alcohol, which might seem a bit surprising. This creates a significant and growing alcohol industry in the country. The mix of traditional values and modern indulgence is like a puzzle in understanding how people behave, and it shows that studying the reasons behind alcohol consumption is essential for grasping its effects on individuals and society.

Bar and Restaurant: A Microcosm of India’s Booze Economy

Tucked away in the lively student town of Manipal, the Swathi Bar and Restaurant emerges as a microcosm, offering insights into the intricate relationship between India and alcohol. This small establishment, reminiscent of a traditional Dhaba, accommodates around 200 patrons, primarily students. On weekends, it draws in a substantial crowd of approximately 350 students from various colleges, while weekdays see around 100 students seeking a respite.

The pricing strategy employed by Swathi mirrors the diverse preferences and budgets of its student clientele. For instance, a 60ml serving of whisky ranges from an affordable Rs. 130 to a more premium Rs. 440. Similarly, 60ml of rum spans from Rs. 60 to Rs. 130, while vodka, positioned in the middle ground, is priced between Rs. 130 and Rs. 250. Notably, the average meal at Swati falls within the range of Rs. 400 to Rs. 500, suggesting that a significant portion of the establishment’s revenue is derived from food sales.

What sets Swati apart is not just its pricing strategy but its role as a social hub. Beyond being a space for consumption, Swati becomes a meeting ground where students can unwind and engage in social interactions outside the formal classroom setting.

The Swathi Bar and Restaurant provides a tangible example of how behavioral economics influences alcohol consumption patterns among students. The bar’s pricing strategy, for instance, leverages the concept of price elasticity of demand, catering to students’ varying levels of affordability. Additionally, the bar’s social atmosphere and its proximity to the college campuses tap into the influence of social norms on individual behavior.

Behavioral Economics at Play

The Swati Bar and Restaurant serves as a tangible example of how behavioral economics shapes alcohol consumption patterns among students. The establishment’s pricing strategy demonstrates an understanding of price elasticity of demand, tailoring options to students’ varying levels of affordability. Moreover, the social atmosphere and proximity to the college campus highlight the influence of social norms on individual behavior, showcasing the intricate interplay of economic and social factors in alcohol consumption.

The Growing Alcohol Market in India: A Macro Perspective

Zooming out to a broader view, India’s alcohol market is experiencing robust growth driven by factors such as urbanization, rising disposable income, and premiumization. Data from a study projects the market to generate a staggering US$47,500 million in revenue by 2022, with an expected annual growth rate of 8.86% from 2022 to 2025. The COVID-19 lockdowns, while initially affecting alcohol’s “essential” status, led to a surge in home consumption and a shift towards premium brands.

Changing Landscape of the Alcohol Market

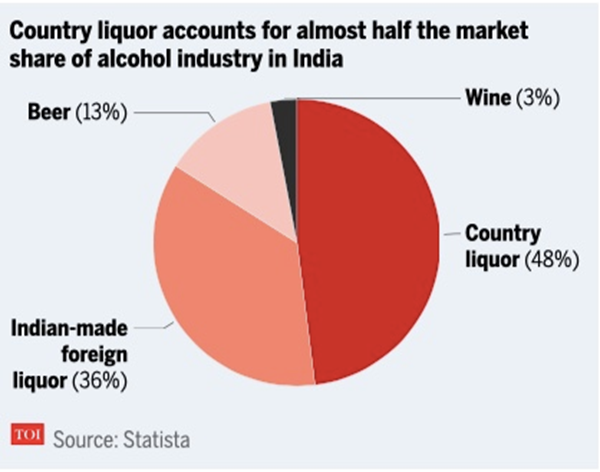

The liquor market in the Indian subcontinent has undergone transformations, driven by the emergence of affordable premium labels and shifts in drinking habits, especially among the younger demographic. The primary components of the alcohol industry include Indian-made or -manufactured foreign liquor (IMFL), Indian-made Indian liquor (IMIL), wine, beer, and imported alcohol. Whiskey stands out as the dominant category within IMFL, while vodka is gaining prominence due to the rising number of pubs, hotels, restaurants, evolving nightlife trends, and changing consumer preferences. An Indian whisky has been declared best in the world at the 2023 Whiskies of the World Awards, placing India at the top of the global whisky landscape.

The Indri Diwali Collector’s Edition 2023 won the coveted title of “Double Gold Best In Show” in one of the largest whisky-tasting competitions in the world, beating over a 100 other varieties including scotch, bourbon and British single malts.

As per a Drinks Market Analysis conducted by the London-based International Wines and Spirits Record (IWSR), India holds the distinction of being the world’s largest consumer of whiskey. Furthermore, the Indian alcohol market is witnessing rapid expansion, with substantial demand for wine and vodka. A study conducted by ICRIER (Indian Council For Research And International Economic Relations) and law firm PLR Chambers indicates that the evolving drinking patterns among Indian consumers reflect an increased exposure to foreign brands and international travel.

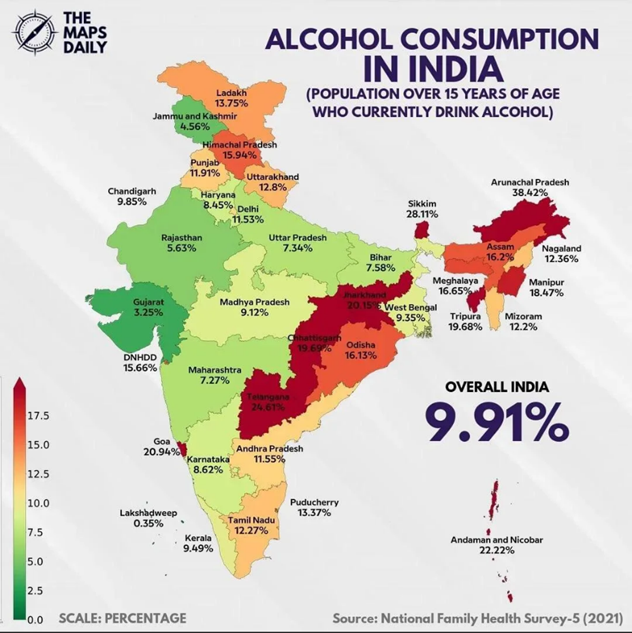

State Contributions and Governance Models

States employ diverse governance and pricing models for alcoholic beverages, maintaining complete control over the supply chain, including production, distribution, registration, and retail through excise policies. This sector is open to foreign investments, with several states offering subsidies for local manufacturing, such as Maharashtra and Karnataka for wines. Alcoholic beverages consistently rank among the top three revenue generators in most states, contributing significantly to their “state own tax revenue” (SOTR) earnings. Since the Goods and Services Tax (GST) does not apply to alcohol, various taxes and fees persist, including excise duty, state value-added tax (VAT), and fees like gallonage fees and license fees. The northeast states, with high alcohol consumption rates, particularly in Arunachal Pradesh, witness a substantial contribution of alcohol taxes to the exchequer. Notably, the revenue generated from alcohol plays a vital role in state finances, with the Center sharing approximately half of the total revenue.

In terms of specific state revenues, Tamil Nadu amassed nearly Rs 38,000 crore in the last fiscal year, while Telangana achieved Rs 40,000 crore. Telangana’s alcohol sales reached an impressive Rs 54,000 crore over the past two years, anticipating a surpassing of Rs 40,000 crore in the upcoming fiscal year. The Delhi government projected alcohol sales of Rs 9,454 crore for 2022–2023, with Rs 700 crore from local spirits and Rs 8,754 crore from imported liquor and spirits, marking a substantial 57.6% increase from previous years. Conversely, West Bengal recorded its highest monthly alcohol sales revenue on December 21, reaching almost Rs 2,000 crore, nearly 25% more than the pre-COVID level.

Future Projections and Conclusion

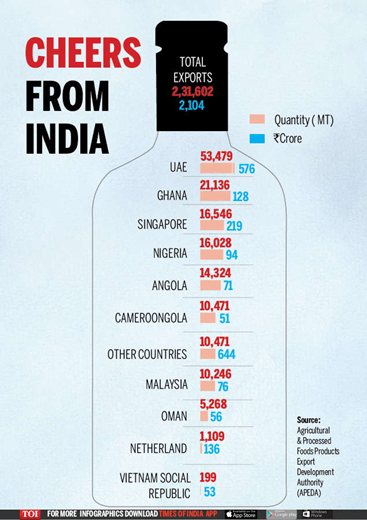

The alcohol industry has quickly recovered after lockdown, which is a sign of its robust and sizable consumer base, which is increasingly made up of millennials and Gen Z. Numerous homegrown brands have carved out a place for themselves in the segment as alcoholic beverage companies have made their way into the domestic market. They are maximizing the potential of digital media, which is assisting the segment’s expansion in numerous ways. In contrast to the past, alcohol brands can now advertise their goods through digital platforms, social media, concerts, events, and a variety of other venues.

Currently, this industry supports approximately 20 million jobs, and with its growing landscape, further employment opportunities are likely to be created. The alcohol industry is a significant sector of the Indian economy. It not only provides the states with up to 2 lakh crores in revenue, but it also directly supports nearly 40 lakh farmers.

ICRIER estimates that by 2030, 50% of Indian drinkers will continue to purchase more products in the same category of alcoholic beverages, 26% will switch to higher-end brands, and 24% will spend money on newer alcohol categories. With this robust growth prospective, India is likely to dominate the alcohol beverage market in the upcoming years. In conclusion, although the alcohol industry’s economic strength is impressive, we need to be cautious. The expected growth makes us think about the bigger impact on society, especially people’s health. As India aims to lead the global alcohol market, it’s important for policymakers to carefully balance economic success with potential risks to public health. They need to navigate this complex economic landscape with care

Leave a comment