Top Insights

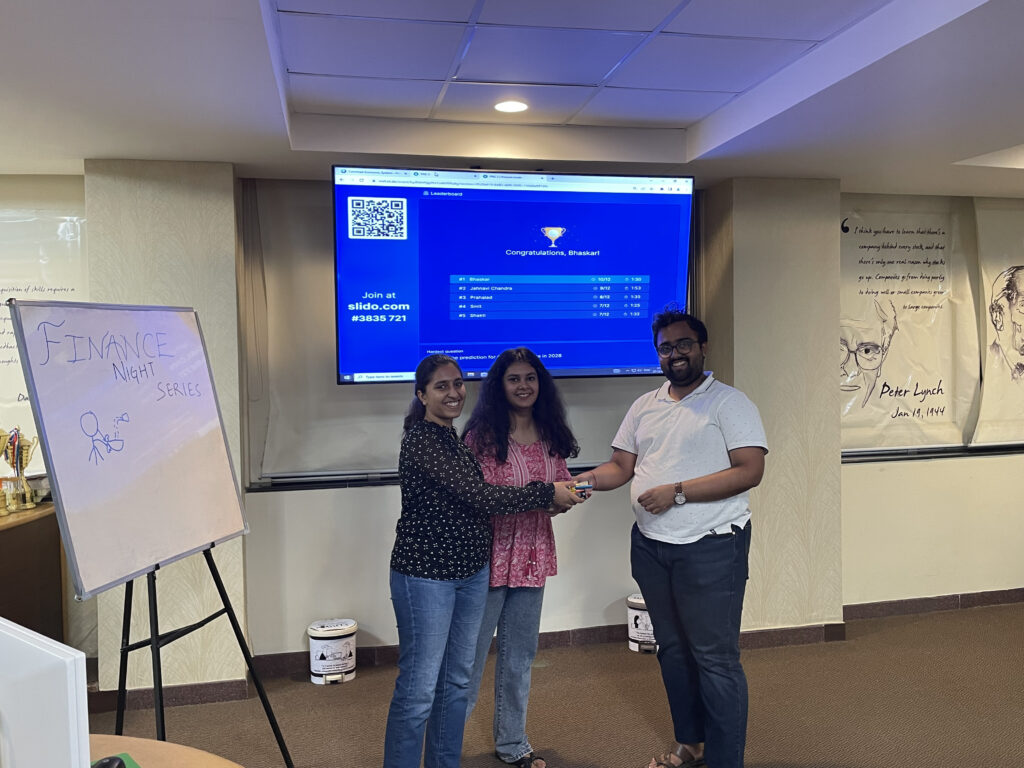

FNS 2023-24

Session 1:

Topic: Digital currency vs Payment gateway

Dive into the future of transactions: Digital currencies

offer decentralized power, while payment gateways streamline convenience. One

revolutionizes control, the other enhances ease – which path will shape our

financial landscape?

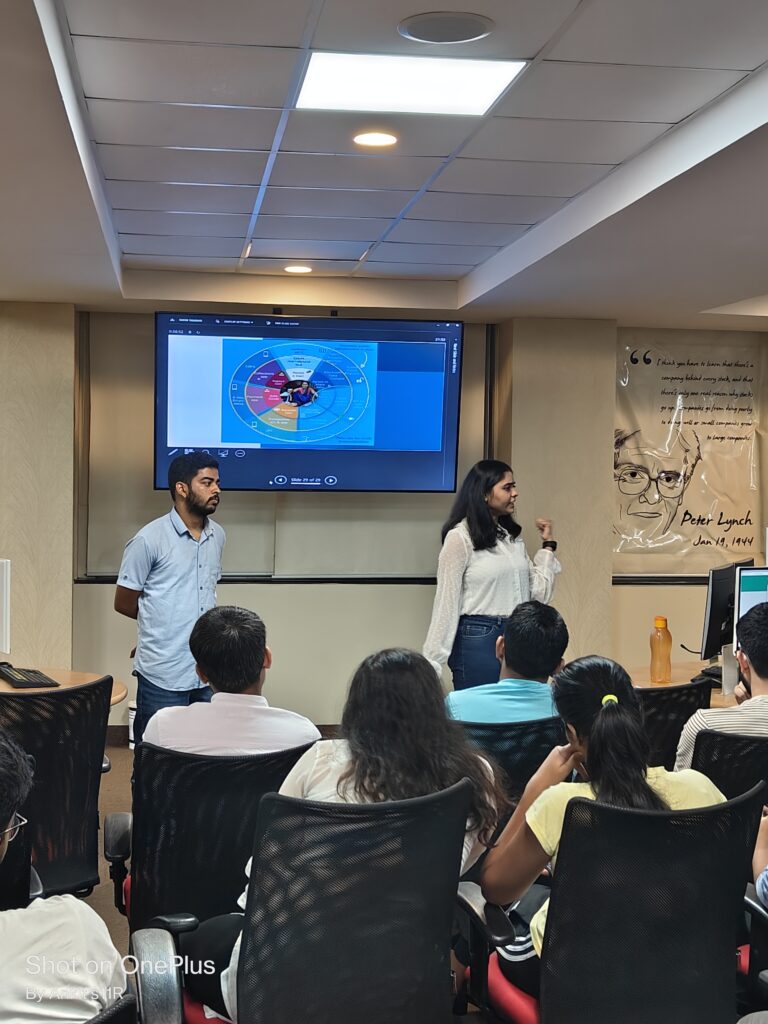

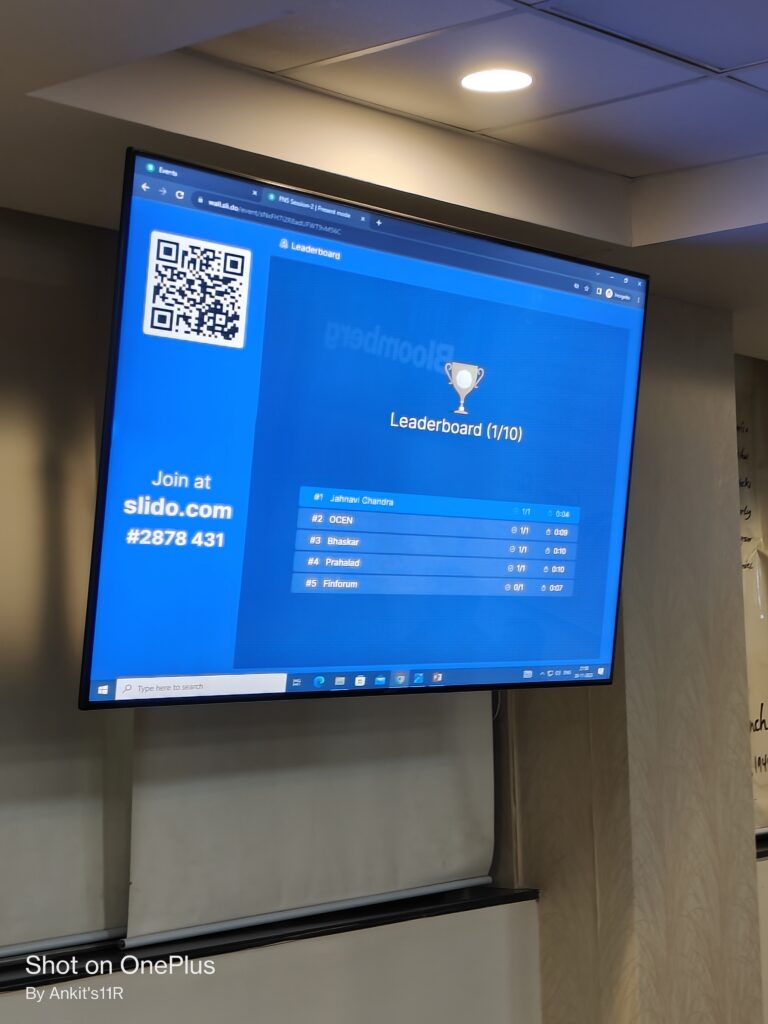

Session 2:

Topic: OCEN (Open credit enabled network)

OCEN, or Open Credit Enablement Network, is a revolutionary framework designed to transform the credit landscape. OCEN aims to facilitate universal access to credit by creating an open and interoperable ecosystem. This innovative platform is poised to streamline credit delivery, enhance transparency, and foster financial inclusion.

Session 3:

Topic: Decoding India’s 7.6% GDP

India’s GDP gallops at 7.6%, a shimmering oasis in a parched global landscape. But is this mirage or oasis? Join us as we trek through the data dunes, unearthing the hidden truths of this economic surge. From bustling bazaars to silent farmlands, we’ll chase the whispers of inequality and unsustainability. Is this growth gold, or just fool’s gold? Let’s decode India’s economic ascent, one number at a time.

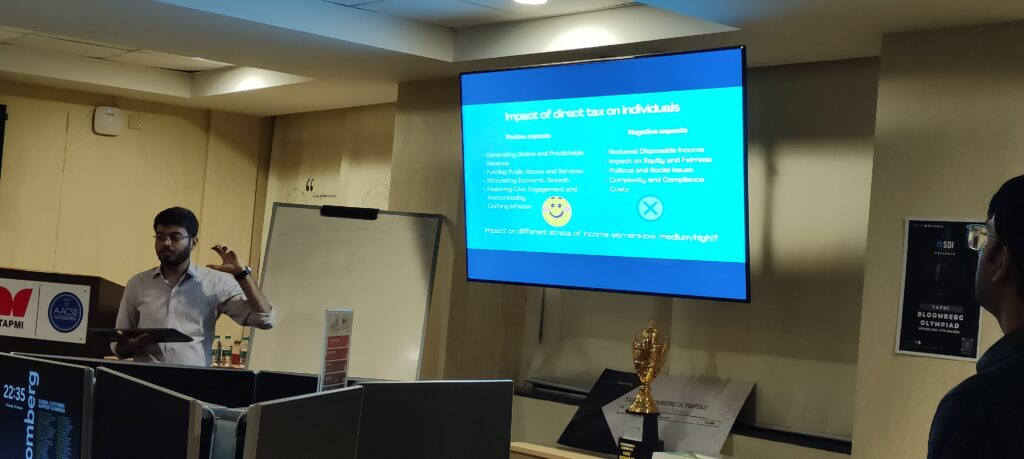

Session 4

Topic: Quantum of direct tax on individual. Can India be a direct tax free country ?

Picture pristine landscapes where the weight of direct taxes lifts, and your hard-earned money stays where it belongs – with you!. Embark on a thrilling escape with us – a journey to discover the elusive land of potential tax freedom!

Session 5

Topic: RBI regulations hindering fintech’s growth

The Indian fintech industry, a booming sector, faces potential roadblocks as some argue the Reserve Bank of India’s (RBI) regulations might be hindering its rapid growth. While these regulations aim to ensure consumer protection and financial stability, concerns remain about stifling innovation and agility, potentially slowing down the evolution of financial services in India.