Editor – Swetha TM ||

Why hasn’t the credit card died, despite its exorbitant bank fees, dwindling appeal in the tech world, and ongoing safety concerns? Credit cards have been extremely popular in India during the previous decade. Both large names, such as Kotak Mahindra Bank and the dependable State Bank of India, have been sending out a variety of dazzling cards. Plus, as technology advances, people are swiping those cards left and right, especially now that everything is digitized.

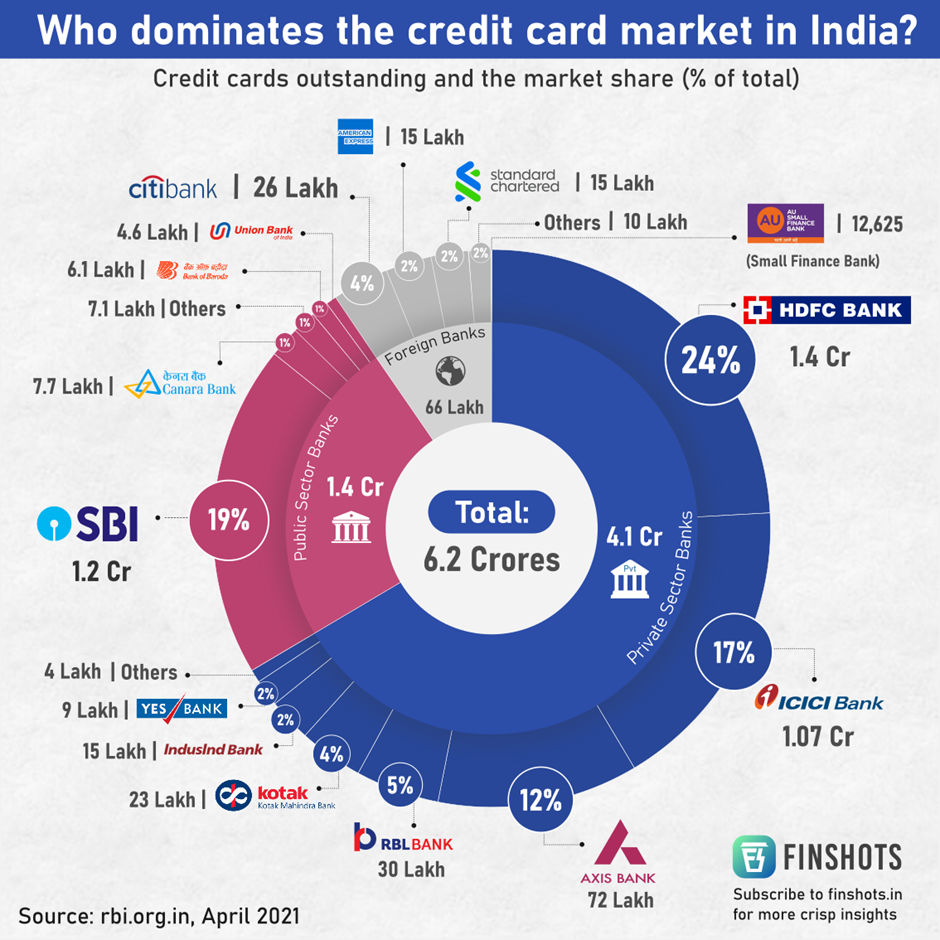

Remember demonetization? When there was a severe cash shortage? This increased people’s reliance on credit cards for their shopping demands. Fast forward to January 2018 and BOOM! The Reserve Bank of India revealed that a staggering 36.2 million credit cards were in circulation. Folks, it appears that the credit cards are not going anywhere just yet.

Remember when our wallets were full of cash, cards, permits, and IDs? It was like carrying a little workplace in our pockets: convenient yet perilous. Losing it meant more than money.

Credit cards are like two-edged swords. On the one hand, they’re quite useful for purchasing items you need or want, and they come with some built-in security protections that cash cannot equal. However, they are also responsible for putting a large number of people in deep debt.

It makes you ask, though: do you really need to use credit cards for your purchases?

But hey, the times have changed! We are going digital. No more hefty wallets or sweating terror when we lose them. Thanks to technology, we can say goodbye to tangible documents. Who needs to carry around all those cards and papers when they can be safely saved on our smartphones?

The typical credit card charge for most Indians is less than ₹2,000. Even during the peak of covid, card spending was never this low. People haven’t grown poor. There has been a trend of people limiting their credit card purchases since the launch of platforms like Paytm, which was so seamless and efficient that it felt as if finance had been liberated from government bureaucracy.

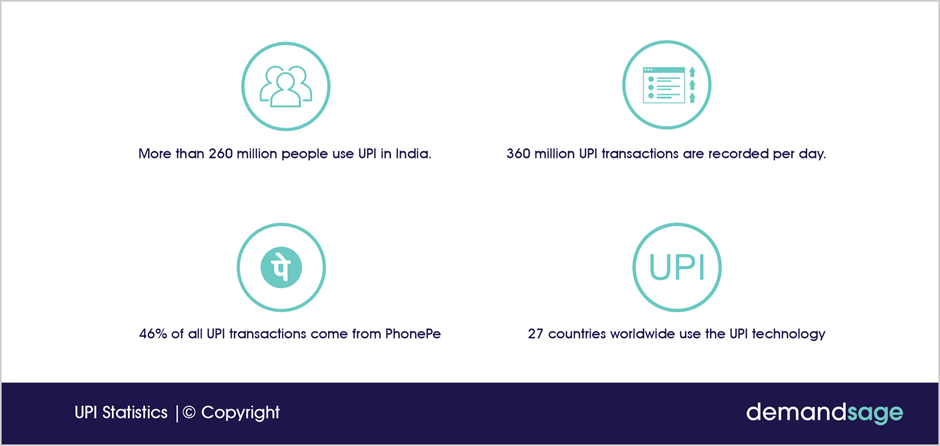

Most people began with minor purchases, but with the introduction of the Unified Payments Interface (UPI), they began utilizing the app for larger online transactions. In recent years, many of my friends have only used their credit cards when they had no other option, such as when they were traveling outside of India, when they would be charged 3.5% of the transaction value and an unfavorable currency exchange rate. If it weren’t for global financial bureaucracy, we wouldn’t need credit cards at all.

I never required the ‘credit’ portion of the card. Most folks do not. Every day, I marvel why e-wallets and UPI have not already replaced credit cards. Credit card usage and customers continue to grow in India. However, Paytm’s payments bank has been severely impacted by Indian financial regulators. In my opinion, credit cards are no longer relevant.

Historically, the credit card was considered a technological marvel. But not anymore. Without the marvel, it’s just a tempting proposition from a cunning moneylender.

Take protection money on every international transaction simply for having a monopoly over the gateways. These examples highlight the importance of cryptocurrency and why governments and banks would not have allowed it to survive. Credit card companies charge 3.5% for all international transactions. When a hotel blocks a deposit and eventually releases the money, the banking system charges 3.5% for each transaction, based on a varying interpretation of exchange rates.

However, transactions back home in India are not fully free, as the merchant at the point of sale pay a fee, which is then passed on to the client. The bank offers “reward points” for using the card, which may be redeemed for non-essential items and coupons. However, these “rewards” merely serve to remind us that we are paying an additional fee when using the card.

I agree that “zero-interest” equated monthly instalments (EMIS) are useful for persons who seek to acquire an expensive commodity they may or may not need, and that a zero interest EMI is genuinely $0. Nonetheless, merchants use such schemes to entice customers, resulting in a cost for the “zero-interest emi,” even if it is unnecessary.

As we have more modern options, I feel terrible for Paytm, which was how many of us discovered ‘fintech.’ Paytm seeded a bank that the Reserve Bank of India has crippled due to “non-compliance.” Millions of consumers will see behavioural changes due to their familiarity with Paytm’s interface, rather than serious financial consequences. RBI should provide detailed reasons for the hard blow. However, the problem is not precisely described. We only have unidentified sources citing problems. The venerable bank has had issues with Paytm for some time over know-your-customer processes, false compliance, and inadequate safeguards against data sharing with foreign companies.

And guess what? Even credit cards are getting a makeover. Say hello to the age of smartphone supremacy! According to Anuj Kacker, Co-Founder of MoneyTap, our dependable phones can now handle the heavy lifting. With safe apps that link our credit cards, we can strut around town and make payments with a simple tap on our devices. Now that is life in the future!

The longstanding dominance of credit cards are being significantly challenged. Here’s why we might see a reduction in cards during the next few years:

- Mobile wallets: Consider this: your entire wallet is packed into your smartphone. Mobile wallets enable you to digitize and securely save your cards on your device. When it’s time to pay, simply pull out your phone and touch away—no physical card required.

- Host Card Emulation (HCE): This cutting-edge technology enables your phone to mimic the behaviour of a credit or debit card. While Apple Pay employs a dedicated chip inside the device, other platforms are going a step farther by mimicking cards without the need for any hardware. It’s like carrying a virtual wallet in your pocket.

- Tokenization: Tokenization involves your phone storing digital tokens that reflect your payment credentials. These tokens can be used for transactions in the same way that actual cards are, but without the risk of sensitive information being exposed. You can keep many tokens on your device, offering you greater flexibility and security when making payments.

- QR, SWAP, and ZAPP codes: Say goodbye to swiping and tapping; QR codes and other barcodes are transforming the way we pay. Furthermore, these coupons can unlock exclusive savings and prizes, making shopping even more enjoyable.

- Internet of Money (IoM): The future of digital payments revolves around interconnected gadgets. Consider using your smartwatch, fitness tracker, or even your car’s dashboard to make payments smoothly. With the Internet of Money, the possibilities are limitless.

So, while cards still have some influence, the rise of digital alternatives is changing the way we think about payments. Prepare for a world in which credit cards are no longer dominant and digital ease reigns supreme.

References:

https://finshots.in/infographic/who-dominates-the-credit-card-market-in-india/

https://www.linkedin.com/pulse/do-we-need-cards-anymore-ramesh-mathikumar/

Leave a comment