Editor – Sowmika Konduru

There has been an increasing amount of focus on the relationship between oil price shocks and investor sentiment. Shocks to the oil price have a significant impact on macroeconomic factors, but investor sentiment has a major role in influencing investment actions and financial market anomalies. In the crude oil market, investor sentiment has emerged as a novel notion in recent times. In actuality, one of the key elements influencing investors’ choices in the financial markets is investors’ sentiment. A growing amount of research has been produced to examine the connection between investor sentiment and the price of crude oil.

Shocks to the price of oil actually have the ability to postpone or alter critical choices on investments, production, and other matters because of its commodity and financial properties. In such a scenario, changes in the oil market necessarily ripple through to the financial and economic systems, influencing the actions and, consequently, the mood of investors.

Thus, our analysis suggests that the price of crude oil influences investor attitude via the stock market and actual economic issues. The first premise is supported by earlier research discussing how shocks to the overall level of oil prices may have a big impact on macroeconomic circumstances and actual economic activity. In turn, investor confidence and mood on their economic activities are greatly impacted by the macroeconomic conditions. A higher oil price, for instance, is typically linked to a challenging macroeconomic climate, which raises interest rates and fosters strong inflationary expectations, both of which lower investor sentiment(Apergis et al., 2018).

The second hypothesis is based on mounting evidence that changes in the price of crude oil have a significant impact on stock markets. The state of the stock markets has a significant influence on investment decisions, which in turn affects investor attitude. Shocks to oil prices have a growing impact on stock markets and a strengthening effect on investor mood. In truth, the price of oil has a ripple impact on investor mood. Consequently, it is important to investigate the potential impact of oil prices on investor sentiment in financial markets.

Additionally, examining how oil prices affect investor sentiment offers a fresh viewpoint on what influences sentiment, which is crucial because mood among investors is a predictor of future economic situations. Furthermore, knowing how the price of oil influences market mood may assist investors manage risk and hedging methods. It can also have ramifications for policymakers, who can utilise this knowledge to produce more accurate predictions and limit future economic cycle changes.

Source – https://www.mdpi.com/1996-1073/15/3/687

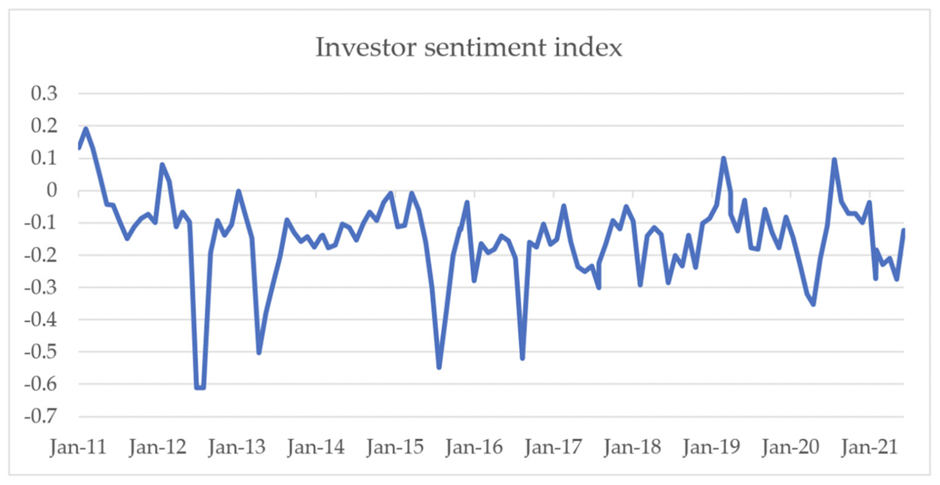

The sentiment of investors fluctuates greatly from January 2011 to June 2021. The trends in investor sentiment from January 2011 to June 2021 are depicted in the above image. We may infer from investor sentiment patterns that sentiment is erratic, indicating that sentiment can serve as a useful buffer against outside shocks. First, the majority of the investor sentiment index is less than zero, indicating that the majority of the time between February 2011 and June 2021, investor sentiment was negative. Second, investor sentiment is subject to dramatic fluctuations when extraordinary occurrences occur. For example, investor sentiment went abruptly negative between May and August of 2012, then gradually decreased until March of 2013.

Furthermore, on June 15, 2015, the Chinese stock market crashed, which precipitated a precipitous decline in investor confidence in July 2015. In addition, investor sentiment improved in August 2016 as a result of the construction of China’s Xiongan New Area and the rapid growth of Chinese industry. Furthermore, China’s economy and the global economy were clouded by the COVID-19 outbreak in 2020. This created a lot of uncertainty, which clouded the stock market and caused investor confidence to drop precipitously. Furthermore, there are significant swings in investor sentiments at various times, such April 2013, May 2017, February 2018, February 2019, January 2021, and so on.

Drones targeted Saudi Aramco’s oil fields on September 14, 2019, causing a 5.7 million barrel per day (or almost 5% of world output) production halt and a greater than 10% increase in oil prices. Massive oil price shocks are not unusual in history, and they are frequently accompanied by sharp declines in economic activity. For instance, recessions were caused by both the demand shock that occurred in 2007 and 2008 and the supply shocks that occurred in the 1970s.

Scholars vehemently contend that arbitrageurs frequently lack the ability to reverse mispricing caused by noisy traders when stock prices move away from their underlying values because of arbitrage risk. But arbitrage risk needs to be binding in order for the limits-to-arbitrage argument to hold water. For the following reasons, we think arbitrage risk might be important in the oil and gas sector.

First, arbitrageurs may find it too expensive to hedge the risk associated with shocks to oil prices, and in certain situations, ideal hedging instruments might not even exist. One well-known example is the German corporation Metallgesellschaft AG, which lost over $1 billion in 1993 as a result of their energy derivatives hedging position. Secondly, there are notable differences in the behaviour of distinct oil price shocks. For instance, aggregate demand shocks appear to last longer, thus arbitrage risk might still be significant even for long-term value investors with “deep pockets.” Third, because companies in the oil and gas sector are sometimes hard to assess because of their physical characteristics, geopolitical risks, and financial and operational complexity, arbitrageurs are also confronted with the information asymmetry problem.

Thirteen of the fifteen notable abnormalities in the capital markets are strong empirically in the oil and gas sector. Furthermore, it is discovered that a large number of these anomalies have a strong correlation with investor mood and oil price shocks, particularly those involving aggregate demand. In particular, four anomalies—composite equity issues, investment to assets, net stock issues, and value effect—are greatly impacted favourably by market mood. We find that, among the three oil shocks, aggregate demand shocks significantly affect six anomalies: return on assets, composite equity issues, financial hardship, net stock problems, and idiosyncratic volatility.

Since investor sentiment is vulnerable to fluctuations in macroeconomic conditions, oil price shocks can have a major impact on actual economic activity and macroeconomic indicators including economic growth, inflation, and consumption (He, 2020). In the meanwhile, several studies have demonstrated the substantial impact of variations in the price of oil on stock market return. Shocks to the oil price will thus unavoidably impact investor mood in the stock market.

Ding et al. (2017) discovered that a 1% rise in crude oil price swings adversely impacts stock market sentiment by 3.94% using a structural vector autoregression (SVAR) model. Additionally, there is an average eight-month contagion delay between changes in the price of crude oil internationally and investor mood in the Chinese stock market. The impact of structural supply and demand shocks on U.S. consumer confidence was examined by Güntner and Linsbauer (2018). They discovered that consumer confidence is strongly impacted by precautionary and total oil demand shocks. But according to He and Zhou (2018), investor sentiment in the US is solely impacted by demand shocks unique to the oil industry.

Research indicates that because of the commodity and financial characteristics of oil, price shocks might affect choices regarding production, consumption, investments, and other matters (Xiao et al., 2018). In these circumstances, changes in the oil market have an inevitable impact on the financial and economic systems, which in turn influences investor attitude and decision-making (He, 2020). Thus, research suggests that the price of oil influences investor mood via two different channels: actual economic conditions and the stock market (He, 2020). It is important to remember, nevertheless, that different nations that buy and sell oil will experience different effects from oil shocks. Shocks to the overall level of prices in oil-exporting nations can have a major effect on the macroeconomic environment and actual economic activity.

Oil shocks mostly impact real economic variables through the GDP channel in nations that export oil. Considering oil prices and related shocks can impact stock returns and/or stock prices through projected revenue from future cash flows, changes in oil prices in exporting nations enhance their revenues, which in turn affects the demand for products and financial assets. Various businesses and economic sectors, including those in the stock market, react differently to oil shocks based on whether they use oil and its derivatives as inputs or outputs. An increase in oil prices causes cash flows to rise in businesses where oil is an output, but cash flows may fall in businesses where oil is a major input (Abu-Nuri & Ziauddin, 2020).

Investor confidence and attitude towards economic activity are also significantly impacted by macroeconomic conditions. As an illustration, rising oil prices typically result in a challenging macroeconomic climate, high inflationary expectations, and higher interest rates in nations that import oil, all of which have a negative impact on investor mood (Apergis et al., 2018). On the other hand, as oil prices rise, investor confidence in nations that export oil rises. Furthermore, as previously said, there is a wealth of data indicating that changes in the price of crude oil have a significant effect on the stock market and its related businesses. An significant aspect influencing decisions made by investors and ultimately impacting investor sentiment is the performance of stock markets and various industries.

It has been extensively shown that investor attitude has a major impact on the price of crude oil, which is important to the world economy. More crucially, severe events can cause significant shifts in investor attitude and/or energy markets. Examples of these occurrences include natural catastrophes, macroeconomic news releases, and changes in the geopolitical environment. In times of crisis, when investors witness a significant decline in the value of their portfolios, they often overreact, exacerbating the situation rather than taking a measured approach(Zhang and Li, 2019). It goes without saying that during a crisis, like the Great Recession, when many investors panic or are compelled to sell assets at low prices, the crude oil futures market is more volatile.

Narratives in the news and media also influence investor sentiment. A dramatic headline on geopolitical tensions in the Middle East may cause investors to flee to oil as a safe haven, hence hiking up prices, out of concerns of supply disruptions. On the other hand, information about technical advancements in alternative energy may stifle demand for oil and lower prices. Investor confidence can be gently impacted by small changes in language used by government officials or business leaders, which can have a subtle effect on market choices.

The effect of sentiment on oil prices is further amplified by technology. Small-scale and novice traders both may now participate in the oil market because of the democratisation of access brought about by online trading platforms and algorithmic investing tactics. Increased market volatility may result from this increased participation, even if it may also offer new insights and liquidity. Echo chambers and social media feeds can produce self-reinforcing cycles of optimism or pessimism, which can quickly affect these new participants’ purchasing and selling decisions and cause abrupt price fluctuations.

There is more than one type of interaction between oil prices and market mood. Variations in the price of oil alone have the potential to influence investor mood. An abrupt increase in oil prices might lead to economic concerns, which would discourage investment and sour attitudes even further. In contrast, an extended period of low oil prices may indicate a weakening of the economy, prompting investors to look for safer investments and further weakening the market. This complex reciprocal relationship may intensify or lessen the original price shock through positive or negative feedback loops.

Understanding how emotion affects changes in oil prices can help individual investors make better judgements. Investors may reduce their exposure to emotional whipsaws and steer clear of pursuing erratic patterns by distinguishing between sentiment-driven and fundamentally-driven price swings.

https://www.sciencedirect.com/science/article/pii/S1059056018309857

https://www.mdpi.com/1996-1073/15/3/687

https://www.sciencedirect.com/science/article/pii/S1057521920301605

https://www.ijfifsa.ir/article_138323.html

https://www.sciencedirect.com/science/article/pii/S0140988321002255

Leave a comment