The recent decision by the government to remove Dividend Distribution Tax means that the shareholders will now have to pay the tax on dividends they receive. How unfair is it to the shareholders? Or is it really? Let’s dive in.

In India, there is a tax that is imposed by the government on the companies that paid dividends to its shareholders. Although it’s not taxable in the hands of the shareholders, ultimately their share of profits become less. When the company is paying tax for its shareholders, all the shareholders have been charged a flat rate of 20.56% irrespective of their economic status.

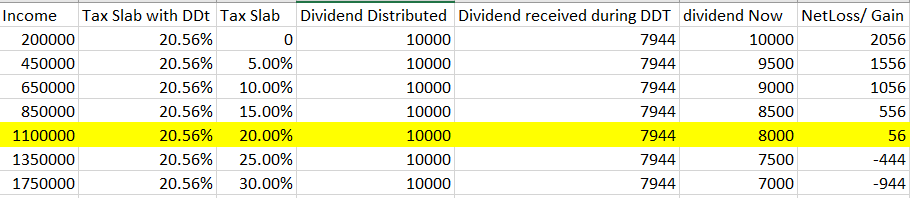

Let us examine how the reform (removal of Dividend Distribution Tax (DDT)) changes things.

From April 1, 2020, the companies would not be charged the DDT when they distribute the dividend. It will be the shareholders who receive the payment, on whom the tax will be imposed. Let’s just suppose, Hari and Krishna were two shareholders and they’ll receive their part of dividends from the full amount that the company had set aside for dividends. No tax has been charged on the amount set aside. It will be Hari and Krishna who’ll be paying the tax now. Here is where things become interesting and fair. The same tax percentage will be charged on the dividends received as is defined by the tax slab they fall in according to the income earned. Both the shareholders will now pay a different percentage of tax on the dividend received.

Suppose Hari belonged to the lower income group with under Rs 2 lakh income. He comes under the tax slab of 0% and therefore is not liable to pay the tax on dividends received. So, on dividend declaration of Rs 100 previously Hari was getting Rs79.44 at 20.56% DDT due to indirect incidence of DDT. But now he’ll be getting full Rs 100 and won’t be taxed.

On the other hand, Krishna who is high net worth individual and falls in the highest tax slab of 30% (can go up to 43%) will be paying that much percent on the dividends received as well. Along with High Net Worth Individuals(HNI), Promoters of the corporations we talked about earlier will also stand to lose due to this new regime. The one who earns more is taxed more. Progressive taxation at its best. To escape the increased incidence of taxes the HNI’s can invest in Mutual Funds (MNC fund or PSU fund). The HNI’s will get the benefit of pass-through dividends as Mutual Fund’s income is not taxed.

Another stakeholder is the company that is paying Hari and Krishna their dividend. With DDT the company had to deal with several compliances that go along with taxes and incur additional expenses. For example, the company had to deposit DDT within 14 days of declaration or distribution of dividends whichever is earlier. Otherwise, interest is charged on DDT with a rate of 1%.

With the removal of DDT, the onus of paying tax lies on the individual shareholder. Company is free from that burden. Therefore, it becomes easy for it to operate. This will help the ease of doing business in the economy and more companies from foreign markets will find the country attractive to work in.

When the company used to pay the Tax for its shareholders, even though they received reduced income, Foreign investors couldn’t claim Tax credits in their home country. With the Tax incidence now lying directly on the Foreign investors, they are liable to claim Tax credits. This makes their investment in India more lucrative. Hence with the removal of DDT, we will see more Foreign Portfolio Investment (FPI’s) coming in.

As for the government, removal of DDT is a step in the direction of improving the ease of doing in India, something that the government has been targeting from all fronts. The only catch here for the government is that it must forgo Rs 25000 crores of its revenue after the removal of DDT. Economic slowdown followed by a reduction in corporate taxes has already plummeted government’s reserves and now we see the elimination of DDT. But on the flip side, the removal of DDT is directly boosting the income of the Indian middle class. Hence as their purchasing power rises, so does the demand in the market. Therefore, removal of DDT can be the Government’s attempt at curbing Demand-side aspects of the economic slowdown.

Looking at the impact of the removal of DDT on each stakeholder:

- Retail/ small Investors: One of the by-products from the removal of DDT is to increase the participation of retail investors in capital markets. Small investors are sure to be the ones who are going to be benefitted by this step of Government.

- HNI’s and Promoters: This is the only segment that will be negatively affected by the removal of DDT. However, on flipside by investing in Mutual Funds, they can minimize the loss. That’s another impact of the removal of DDT, promotion of Mutual Funds.

- Foreign Investors: They will be able to claim their tax credits in their home country. Hence there won’t be cascading of the Tax and they’ll stand to earn more from India making it a Favourable destination to invest.

- Companies: The High dividend-paying companies would have to worry about the compliances for paying the dividend. Hence it will be easier for them to work in India.

- Government: Only the time will tell if the government can meet its objective of

- Short Term: Aiding the demand-side factors of economic slowdown. Increasing the purchasing power of the middle-class people of India.

- Long Term: To make India a profitable place for Foreign investors to invest in. Making the Indian Tax system just and transparent.

In all, removal of DDT is a major step and has the potential to solve a lot of problems.

Written By – Ritwik Garg

Great Information. Thank you for this brief analysis.

Recently Under Income Tax Act, Changes take place to Residential Status for NRIs. Here are all the FAQs related to these changes. If you have any Queries or doubts go ahead, click the link and get all the answers.

Click Here: https://bit.ly/3fVkkxv