By Jay Thakkar and Harshal Sharma

Introduction

There is great debate over the belief whether inflation promotes economic growth or not. The relationship between inflation and growth is a controversial one not only in theory but also in empirical findings. A group of economists supporting Keynes are of the opinion that inflation is a factor that contributes to economic growth. Keynesian theory states that inflation leads to redistribution of income and wealth. Keynes favors mild inflation on the grounds that it tends to increase business optimism due to rising prices, resulting in high profit expectation that stimulates further investments, output, employment and income. However, another group of economists are of the view that inflation does not contribute to economic development but on the contrary, works as an inhibitor. For instance Milton Friedman completely disagrees with the policy of development through inflation. We have tried to investigate the interactive effects between inflation and economic growth for India and the need for regulating inflation in its current developing phase.

The Relationship between Economic Growth and Inflation

The relationship between inflation and economic output is very delicate. Investors highly value GDP growth, as cash flows that are the key driver of valuation/performance of company’s stocks won’t increase if economic output of a country is falling or is in a steady state. On the other hand, if there is too much growth in GDP it leads to an increase in inflation, which undermines stock market gains as the money and future profits become less valuable than they are today. Today, most economists agree that a growth rate of 2.5 – 3.5% is safely attainable without any negative effects.

Over time, the growth in GDP would lead to inflation, and the rate will keep on rising as inflation engenders inflation. Once this progression starts, it doesn’t take much time for it to become a self-reinforcing feedback loop. The Rational Expectations Theory suggests that in the times of increasing inflation, households tend to spend more money as they are aware of the fact that the money will be less valuable in the future. Because of more expenditure by the people, there is an increase in GDP in the short run that leads to further increase in the prices of the goods and services. Also, a very peculiar feature of inflation is that the effects of inflation are nonlinear, i.e. 10% inflation is not just twice as harmful as 5% but much more than that. Most advanced economies have learned these lessons through experience. In 1980s when there was a prolonged period of high inflation in the US, the economy was restored only by going through a painful period of high unemployment and lost production, as prospective capacity remained idle.

So what is the ideal inflation level? While some economists insist that advanced economies should aim to have 0 percent inflation i.e. stable prices, the general consensus is that a little inflation is actually a good thing.

Relationship between GDP and CPI Growth Rate for India

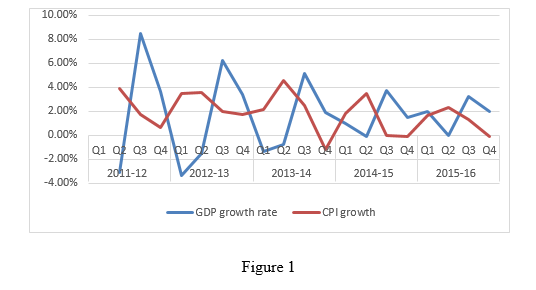

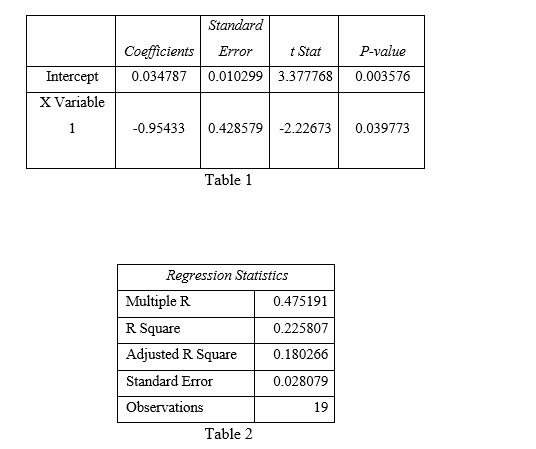

The graph below plots the quarter on quarter GDP growth rate and CPI growth rate. It can be observed that economic growth rate is inversely related to CPI growth rate.

It can be observed that there is a significant relationship between GD growth rate and inflation growth rate represented by a negative correlation coefficient. The value of adjusted R square is low due to other factors like exchange rate, technological development, natural resource availability, social and political conditions that influence the economic growth.

Major Reasons why Economic Growth and Inflation Control can’t go together

When inflation is high, interest rates are hiked. The reason being, a high interest rate will discourage additional borrowings. This shall reduce the amount of money people have in their hands to spend. Traditional economic theory suggests that as demand falls, prices also fall. Thus, RBI aims to control inflation by increasing interest rates. When economic activities falter, a cut in interest rates is required. This is because companies need to borrow in order to invest in new projects. A fall in interest rates reduces cost, thereby increasing profitability. This encourages borrowing, which in turn, helps fuel the economy.

A high interest rate is detrimental to growth. Companies discontinue expansion or growth plans due to high interest rates. They are forced to cut costs to maintain profits. This passes across the economy including the labor market. A low interest rate can cause a rise in inflation. This is a result of more money in the system. This leads to an overall price rise as demand increases. A high interest rate controls inflation but retards growth. In contrast, a low interest rate is beneficial for overall economic growth. Therefore, both economic growth and inflation cannot be targeted together.

RBI’s Stance

The goal of RBI’s monetary policy is primarily price stability, while keeping in mind the objective of growth.

The Dr. Urjit Patel Committee Report posited a few key recommendations; in 2014 a “glide path” for disinflation was announced. The aim was to maintain the CPI inflation at 8% by January 2015 and below 6% by January 2016. The Agreement on Monetary Policy Framework between the Reserve Bank of India and Government dated February 20, 2015 wants to maintain the consumer price index-combined (CPI-C) below 6% by January 2016 and 4% (+/-) 2% for the financial year 2016-17 and all subsequent years. Whilst formulating the monetary policy we focus on price stability and growth. However, the focus on each of these objectives varies across time depending on the evolving macroeconomic conditions. Various changes in the economic environment will dictate alteration of the objectives to facilitate the maintenance of price stability to ultimately achieve growth.

The Reserve Bank of India controls the amount of money in the system as well as the dominant interest rates. It reviews its policy regularly through the credit policy. This is dependent on multiple macro-economic factors like inflation, industrial production data and job growth. This often leads to a debate over growth and inflation control. India has never followed inflation targeting as a tool to control inflation. But, according to Narasimham and Rajan committee the central bank clearly lacks direction and needs one tool to focus on develop their monetary policy. They say that in a country like India where the central bank is independent of the government and the inflation rate is considerably low, a monetary policy targeted around keeping the inflation rate low and stable will accelerate output growth. Inflation targeting helps in reducing inflation volatility and inflationary impacts of shocks. It also leads to increased anchoring of inflation expectation.

There was a lot of backlash regarding this move as people felt that the central bank has various factors to monitor such as price stability, growth and financial stability and that India does not have the framework for the successful implementation of IT such as developed financial markets, confidence of global markets, and independence of RBI. Inflation targeting would also restrict the RBI’s ability to respond to financial crises or unforeseen events. It could also lead to potential instability in the event of large supply side shocks.

Conclusion

A macroeconomic policy ideally should aim at high economic growth accompanied with low levels of inflation. However, in reality, accomplishing both a low inflation rate and a rising economic growth is never possible. However, low inflation rate does not indicate slow economic growth. In situations of excess money, consumers begin the process of bidding which results in escalation of the cost of goods. In the case of Indian economy, a number of studies failed to establish any conclusive relationship between inflation and economic development. Low level of inflation is advantageous for development, but once inflation goes below a certain level it retards economic development. Therefore, it is mandatory to perform inflation control at an acceptable level to promote optimum economic growth.

Appendix

| Year | Quarter | Total Gross | CPI | GDP growth rate | CPI growth |

| 2011-12 | Q1 | 19717.87 | 106.489 | ||

| Q2 | 19109.98 | 110.658 | -3.08% | 3.91% | |

| Q3 | 20737.12 | 112.553 | 8.51% | 1.71% | |

| Q4 | 21501.59 | 113.311 | 3.69% | 0.67% | |

| 2012-13 | Q1 | 20779.26 | 117.29 | -3.36% | 3.51% |

| Q2 | 20468.18 | 121.458 | -1.50% | 3.55% | |

| Q3 | 21743.09 | 123.922 | 6.23% | 2.03% | |

| Q4 | 22474.99 | 126.098 | 3.37% | 1.76% | |

| 2013-14 | Q1 | 22164.9 | 128.856 | -1.38% | 2.19% |

| Q2 | 21990.4 | 134.773 | -0.79% | 4.59% | |

| Q3 | 23122.19 | 138.172 | 5.15% | 2.52% | |

| Q4 | 23566.2 | 136.493 | 1.92% | -1.22% | |

| 2014-15 | Q1 | 23805.34 | 138.971 | 1.01% | 1.82% |

| Q2 | 23781.78 | 143.769 | -0.10% | 3.45% | |

| Q3 | 24661.67 | 143.769 | 3.70% | 0.00% | |

| Q4 | 25026.12 | 143.689 | 1.48% | -0.06% | |

| 2015-16 | Q1 | 25514.35 | 146.048 | 1.95% | 1.64% |

| Q2 | 25520.95 | 149.446 | 0.03% | 2.33% | |

| Q3 | 26353.58 | 151.445 | 3.26% | 1.34% | |

| Q4 | 26883.03 | 151.245 | 2.01% | -0.13% |

Table 3

Source: RBI website

Bibliography

- Inflation and economic growth. (2010, October 13). Retrieved July 28, 2016, from http://www.economywatch.com/inflation/economy/economic-growth.html

- Barnes, R. The importance of inflation and GDP. Retrieved July 28, 2016 from http://www.investopedia.com/articles/06/gdpinflation.asp

- Retrieved July 30, 2016, from http://www.economicshelp.org› Economics help blog › economics

- Gokal, V & Hanif S. (2004, December) Relationship between Inflation and Economic Growth. Retrieved July 29, 2016 from http://rbf.gov.fj/docs/2004_04_wp.pdf

- Mohaddes, K & Raissi, M. (2014, December) Does Inflation Slow Long-Run Growth in India? Retrieved July 28 ,2016, from https://www.imf.org/external/pubs/ft/wp/2014/wp14222.pdf

- Salian, P. & Gopakumar. Inflation and Economic Growth in India –An Empirical Analysis. Retrieved August 1, 2016, from http://www.igidr.ac.in/conf/money/mfc-13/Inflation%20and%20Economic%20Growth%20in%20India_Prasanna%20and%20Gopakumar_IGDIR.pdf

- Disclaimer. (1934). Reserve bank of India – function wise monetary. Retrieved July 29, 2016, from https://www.rbi.org.in/scripts/FS_Overview.aspx?fn=2752

- Help, & Terms, S. P. (2014, August 25). Inflation versus growth: Why RBI can only pick one. Retrieved August 2, 2016, from https://in.finance.yahoo.com/news/inflation-versus-growth–why-rbi-can-only-pick-one-102654757.html

- Tanwar, R (2014, September) Nexus Between Inflation and Economic Development in India. Retrieved August 3, 2016, from http://www.ijhssi.org/papers/v3%289%29/Version-1/J0391063067.pdf

About the author:

About the author:

The author is currently a student of batch 2015-17. His area of interest is Banking, Economics and Corporate Finance. You can contact him at harshalsharma2015@gmail.com

About the author:

About the author:

The author is currently a student of batch 2015-17. His area of interest is Economic Analysis, Corporate Finance and Investment Banking. You can contact him at jaymmakhecha@yahoo.com

Leave a comment