Editor: Arbaz Raza

Saving money feels responsible. Investing money feels risky.

This belief has shaped how generations approach personal finance. But what if the real risk lies in doing nothing? As inflation steadily erodes purchasing power, money left idle quietly loses value. In today’s financial landscape, caution without action is not safety—it is stagnation. The shift from savings to investments is no longer optional; it is inevitable.

For decades, saving has been presented as the ultimate measure of financial discipline. Spend less than you earn, build a cushion, and stay secure. These principles remain valid. Yet the economic environment in which they were formed has changed. Longer lifespans, rising living costs, and evolving career paths have altered the meaning of financial security. What once protected wealth now often struggles to preserve it.

The Comfort Trap of Idle Money

Idle savings create a reassuring sense of progress. Interest credits arrive periodically, balances increase, and discipline appears rewarded. But beneath this surface calm lies an uncomfortable truth: inflation is always at work.

Prices do not wait for financial confidence to improve. Everyday expenses—food, housing, healthcare, education—rise steadily, reshaping what money can buy. When savings grow more slowly than inflation, real wealth declines even as account balances increase.

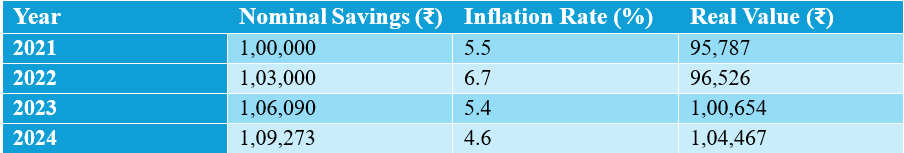

📉 Visual Insight: Inflation vs Idle Savings

What this data highlights is not dramatic loss, but missed momentum. Years of disciplined saving translate into minimal real progress. This is the silent cost of letting money remain idle.

Why Savings Matter—and Why They Are Not Enough

Savings remain essential. They provide liquidity, absorb shocks, and reduce dependence on credit during uncertainty. Emergencies demand immediacy, not market timing, and for this purpose, savings are unmatched.

The limitation lies not in saving, but in over-reliance on it.

Savings instruments are designed for protection, not progression. Their primary objective is capital preservation, often at the expense of growth. Stability is their strength—but stability alone cannot fund long-term goals such as retirement, healthcare, or financial independence.

Investments: Growth Through Participation

Investments exist to address precisely what savings cannot. By allocating capital to productive assets, investors participate in economic growth. Over long periods, this participation has historically delivered returns that outpace inflation.

Volatility often discourages participation, but volatility is not a flaw—it is the price of growth. What separates investing from speculation is structure: diversification, time horizons, and alignment with goals.

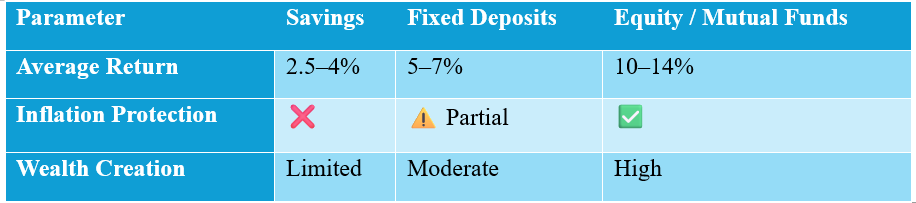

📊 Visual Insight: Savings vs Investments

Savings protect capital. Investments grow it. Both are necessary—but they are not interchangeable.

Time: The Advantage That Cannot Be Recovered

Capital can be rebuilt. Strategies can be refined. Time cannot be recovered.

Compounding rewards early and consistent action. Small investments made early often outperform larger, delayed contributions simply because they are allowed to work longer. Each year money remains idle is a year compounding does not operate.

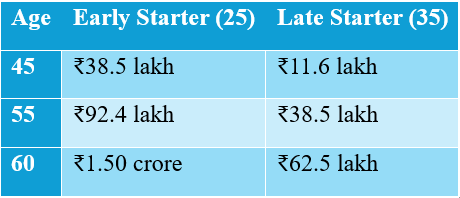

📈 Visual Insight: The Cost of Delay

The gap is created not by income, but by postponement.

Reframing Risk

Avoiding investments is often framed as prudence. In an inflationary environment, inaction itself becomes a risk. Prices rise regardless of preparedness, and future expenses rarely decline.

The real choice is between:

- Market volatility, which can be managed

- Or erosion of purchasing power, which cannot

Informed investing is risk management, not risk-taking.

Conclusion

Savings are the foundation of financial security—but they are not its destination. In a world shaped by inflation and rising aspirations, letting money sit idle is a costly choice.

The shift from savings to investments is not a rejection of discipline, but its evolution. When money is allowed to work alongside time and structure, it moves from passive storage to active stability.

That transition—from protection to participation—is where true financial maturity begins.

Leave a comment