Editor – Swetha Jaya

Consider negotiating property boundaries with adjacent black holes or dealing with anti-gravity garden zoning rules. Maybe one day there will be cosmic condos and nebulae neighborhoods. What if this scenario isn’t that far off in the future? This is what we will go over in depth as we examine the space economy.

Along with the rest of the globe, the space economy is changing rapidly, with private investment and technical advances altering the industry. As a result, the space sector is expected to be a trillion-dollar industry by 2040. We shall investigate the evolution of the Indian space economy and the global space industry. We will also investigate the potential investment opportunities as well as the challenges.

The Space Economy – A Trillion-Dollar Industry

Researchers and other space enthusiasts have long discussed the potential for business activity in space or even the development of space cities. With lower costs and greater technological capabilities, companies may now contemplate space ventures, and for the first time, they might even be able to profit from forays into space. Some hints of the coming changes are apparent, including frequent headlines about SpaceX, Blue Origin, and other private companies launching their own rockets and deploying satellite constellations. In 2021, private-sector funding in space-related companies topped $10 billion—an all-time high and could reach over $1 trillion in value by 2040.

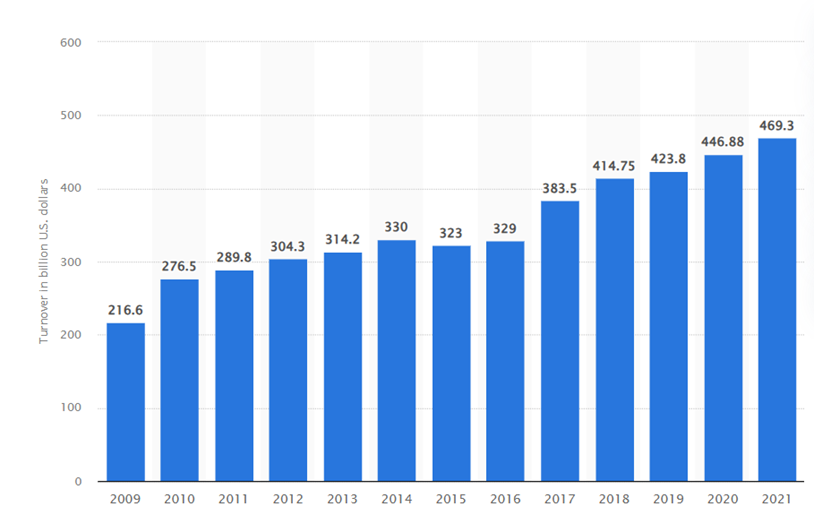

According to The Space Foundation’s 2022 edition of The Space Report, the space economy grew by 9% in 2021, reaching a value of $469 billion. According to the research, almost 1,000 spacecraft were launched into orbit in the first six months of this year, outnumbering the total number launched in the first 52 years of space exploration (1957-2009).

Private companies are not the only ones contributing to space investments. According to the Space Foundation report, there is a global increase in government-backed funding for space initiatives. Total government spending on both military and civilian space programs increased by 19% last year. India increased its spending by 36%, China increased its investment by 23%, while the United States added another 18% to space endeavours.

Will Marshall, the CEO of Planet Labs, stated during the World Economic Forum’s Annual Meeting in Davos in May that the cost of rockets has reduced fourfold in the last ten years. Companies that would have previously paid hundreds of thousands of dollars to launch a satellite into space may now do so at a far cheaper cost, thanks to the availability of more affordable components.

India’s Vision for the Space Economy

The Indian National Space Promotion and Authorization Centre (IN-SPACe) has delineated a comprehensive vision and strategy for the Indian space economy, anticipating a growth from $8.4 billion to $44 billion by 2033. IN-SPACe aims to promote the involvement of non-governmental entities in the space sector, fostering a collaborative environment conducive to economic growth.

India’s space economy is presently valued at 6,700 crore ($8.4 billion), constituting 2% of the global space economy. IN-SPACe, as a self-contained agency within the Department of Space, aspires to elevate India’s space economy to 35,200 crore ($44 billion) by 2033, commanding an 8% worldwide market share. The current valuation of the domestic market stands at 6,400 crore ($8.1 billion), while the export market is valued at 2,400 crore ($0.3 billion). The objective is to augment the domestic market share to 26,400 crore ($33 billion) and the export market share to 88,000 crore ($11 billion) over the next decade, supported by an investment of 17,600 crore ($22 billion).

Investment and Opportunities

India currently hosts a robust ecosystem comprising over 100 space technology startups. The year 2021 marked a pivotal moment for these firms, witnessing investments surge to US$68 million, reflecting a remarkable 196% year-on-year increase. Within the same period, 47 new space technology startups emerged in India. This upswing in investment can be attributed to various factors, including the government’s initiative to engage private entities in the space sector, the cost-effectiveness associated with satellite development and launch, the promise of substantial Return on Investment (RoI), a burgeoning market demand for geospatial data, and noteworthy technological advancements within the space industry.

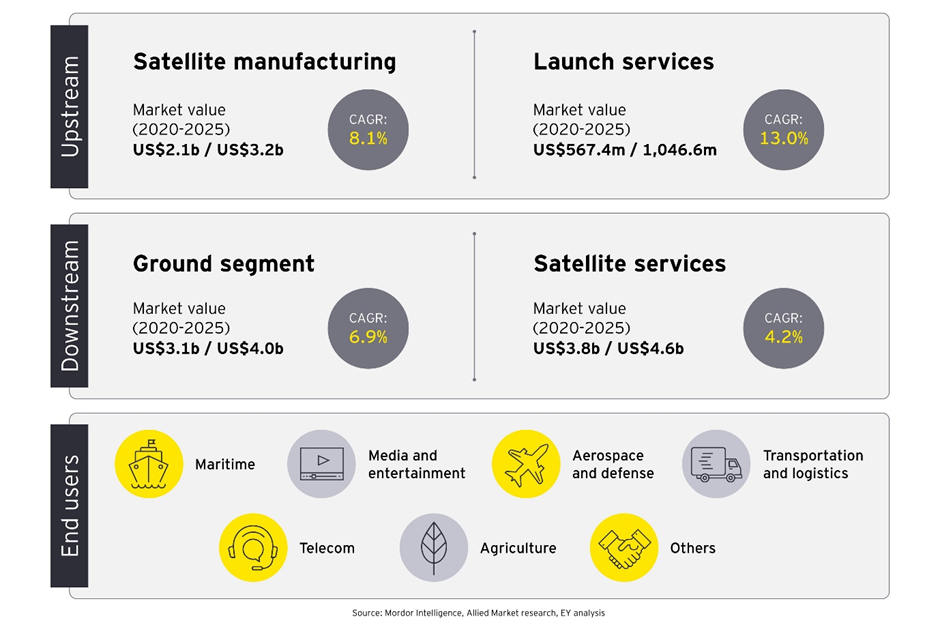

Due to the heightened demand for small satellites, the “Make in India” initiative holds the potential to stimulate growth in satellite manufacturing. Satellite manufacturing is anticipated to become the second-fastest-growing sector in the Indian space economy by 2025. The establishment of space parks throughout the country is poised to benefit enterprises engaged in the entire space value chain, with a specific emphasis on manufacturing. This endeavour is crucial for attracting foreign space startups and nurturing space technology incubation in India. Consequently, the Indian space economy offers lucrative opportunities for investors, aiming to significantly enhance both domestic and export market shares. A projected investment of $22 billion is envisioned in the next decade to propel this growth.

The Global Space Economy

The global space economy is on a trajectory of significant growth. In 2021, it was valued at $469 billion, with substantial contributions from the private sector. The space sector is not only a growth sector in itself but also a key enabler of growth and efficiency in other industries.

According to the European Space Agency, the introduction of new space infrastructure has benefited various businesses, including meteorology, energy, telecommunications, insurance, transportation, maritime, aviation, and urban development.

To improve satellite connectivity, several businesses have recently launched smaller, more cost-effective satellites into Low Earth Orbit (LEO), an orbit suited to high-speed, low-latency communication. With lower costs and enhanced technologies, there is a chance that this tendency will reverse as companies build on existing research from the International Space Station. This study allows pharmaceutical companies to develop cell cultures in space, providing unique growth patterns and insights for disease models.

Similarly, consumer goods businesses may see an advantage in producing items in space, where conditions like strong radiation, near vacuum, and zero gravity may improve design and manufacturing processes. A beauty product producer, for example, may discover unique facts about skincare under difficult space conditions, perhaps impacting aging acceleration. This tendency may make it easier to create factories or manufacturing units in space. Some semiconductor companies are already researching the viability of making chips in space, taking advantage of the natural vacuum to experiment with revolutionary thin-layering processes that minimize or eliminate gases during manufacture.

Visionaries such as Blue Origin’s Jeff Bezos are considering the possibility of enormous populations living and working in space. The recent spike in space tourism headlines could signal a paradigm change, implying that space is no longer reserved for a restricted set of astronauts.

Such opportunities in varied sectors of the economy are what make the space economy a very attractive platform for investment and growth.

Shifts in the Space Economic Landscape

Morgan Stanley Research recently hosted its third Annual Space Summit, convening corporate, government, and venture capitalists to deliberate on the intersection of space exploration and capital markets. Key themes include:

Space and Climate Change: Satellite imagery aids ESG-focused investors by furnishing crucial environmental data, encompassing the monitoring of greenhouse gas emissions and the optimization of renewable energy infrastructure.

Increase in Capital Formation: Despite the challenges posed by COVID-19, the space sector witnessed record private investments last year. There has been a shift from the “old” to the “new” space, and Special Purpose Acquisition Companies (SPACs) have emerged as potential vehicles for long-term space business models.

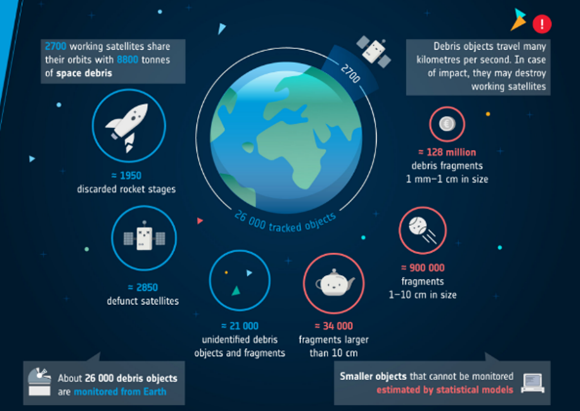

Concerns About Orbital Waste: As satellites become more prevalent, concerns about “space junk” are growing. This has created a market opportunity for private enterprises to detect and manage orbital waste.

Space and Security: Given the contested nature of space, there is an increased need for “space domain awareness,” with satellite providers playing a role in addressing national security concerns.

Telecom Focus: Satellite operators are exploring value at various orbital altitudes, with a focus on providing distinct internet services. They are also navigating legislative obstacles for space as a shared global resource, particularly in low-Earth orbit (LEO).

These trends were underscored at the summit, highlighting the evolving landscape and prospects within the space industry.

Satellite Broadband and Future Opportunities

Satellite broadband is destined to play a critical role in fuelling the global space economy, emerging as a crucial accelerator for industrial growth and accounting for 50-70% of total expansion by 2040. This forecast highlights the growing demand for data, driven by the digital era, the Internet of Things (IoT), and the ongoing expansion of connectivity requirements across numerous industries. The fundamental advantage of satellite technology is its capacity to meet this increasing demand while remaining cost-effective. As the world’s reliance on data for communication, business operations, and creativity grows, satellite broadband emerges as a crucial enabler, providing widespread coverage and bridging connectivity gaps across varied geographical regions. These revolutionary potential positions satellite broadband as a strategic driver of economic development and global connectedness in the future decades, not merely as a technological achievement.

Challenges and Considerations

While the space economy offers immense prospects, it is not without its obstacles, with two major issues to address: space debris and investment risks. NASA estimates that there are approximately 100 million particles in orbit around the Earth, each measuring one millimetre or larger. This space debris, originating from defunct satellites, discarded rocket stages, and impact fragments, poses a genuine threat to active satellites and spacecraft.

Aside from concerns about space debris, there are inherent investment risks in the space sector. The complexity and high costs of space missions, coupled with uncertainty about technological advancements and legal frameworks, all contribute to the risk profile of space-related ventures. However, these challenges also present opportunities for innovation and the development of risk-mitigation solutions.

Addressing space debris and effectively managing investment risks will be crucial in unleashing the full potential of this dynamic and rapidly developing industry as the space economy evolves. Stakeholders can contribute to the sustainable growth of space operations and ensure the long-term viability of the space economy by fostering international collaboration, adopting responsible space practices, and implementing effective risk management measures.

Conclusion

The current status of the space economy is a crucial turning point marked by significant transformation, offering unprecedented prospects for global investors, including those in India. With the ongoing momentum of private investment and rapid technological breakthroughs propelling the business forward, the once-fantastic possibility of acquiring real estate in space is gradually becoming a reality. As the space industry advances, investors stand to gain considerably by understanding the economic mechanisms at work and staying up to date on the latest advancements. Investors can position themselves strategically for potential long-term gains by proactively participating in this dynamic and rising trillion-dollar market. For those interested in exploring the tremendous potential of the space economy, the convergence of innovation, private-sector participation, and expanding market dynamics marks an exciting era.

References

Weforum.org, The space economy is booming. How can it benefit Earth?

https://www.weforum.org/agenda/2022/10/space-economy-industry-benefits/

The Hindu, India’s space economy has potential to reach $44 billion by 2033 with about 8%

Ey.com, The dawn of the space economy in India

Leave a comment