-Srikanth Kumar

As a person grows older, life brings significant changes in lifestyle, responsibilities, and growth. Similarly, it is time for India to respond to the evolving environment around it. Today, this 78-year-old nation has taken a significant step forward by introducing a new income tax draft that is the first major overhaul since 1962, to align with the needs and realities of the modern era.

The new income-tax rules 2026 has come up with significant changes in the following areas of:

- House rent allowance

- Child education exemptions

- Hostel allowance exemptions

- Standard deductions

- Overall tax liability

- Car perquisite valuations

- Interest-free loan limits

- Meal allowance exemptions

- Festival gift exemptions

- Transport allowance cap

How the new framework could boost your salaried take-home pay?

As per the new draft, your salary slip may soon look very different and possibly heavier. The government has proposed the Draft Income-tax Rules, 2026 to replace the six-decade-old 1962 rules, and the changes directly affect what finally lands in your bank account every month. Higher HRA limits, realistic education and hostel allowances could significantly reduce taxable income for salaried employees, especially those using the old tax regime. The draft is open for public comments until February 22. Now, let us look at the changes individually.

Changes in House Rent Allowance (HRA)

HRA changes have been expanded the list of cities eligible for 50 percent salary-based HRA exemption. Apart from Mumbai, Delhi, Kolkata and Chennai that already fall under 50% bracket, the proposed rules add Bengaluru, Hyderabad, Pune and Ahmedabad to the 50 percent category. All other cities will continue under the 40 percent cap.

Major boost to education and hostel allowances

The earlier limits under the Income-tax Rules, 1962 had remained unchanged for decades and were widely considered outdated given rising schooling costs, therefore, the education and hostel allowance exemptions have been proposed to be significantly increased under the Draft Income-tax Rules, 2026.

The exemption for children’s education allowance is proposed to rise from Rs 100 per child per month to Rs 3,000 per child per month. This is a significant increase of 30 times than what it was before. Similarly, hostel allowance exemption will also increase by 30 times, that is from Rs 300 per month to Rs 9,000 per month per child, for up to two children.

Motor car perquisite

One of the notable changes relates to company-provided vehicles. Under the current rules, valuation figures for mixed official and personal use had remained static for decades.

The draft proposes upward revision. For cars up to 1.6 litres where the employer bears fuel and maintenance costs, the taxable perquisite rises from Rs 1,800 per month (plus Rs 900 for driver) to Rs 5,000 per month (plus Rs 3,000 for driver). For larger engines, the perquisite increases from Rs 2,400 to Rs 7,000 per month, with chauffeur valuation tripling to Rs 3,000 per month.

Tax experts say this could significantly increase TDS for executives who opt for company-leased vehicles as part of their compensation.

Interest-free loan exemption raised tenfold

Due to the earlier exemption had become largely irrelevant due to inflation, the draft rules increase the threshold for exempt employer-provided interest-free or concessional loans from Rs 20,000 to Rs 2 lakh. The proposed revision offers relief to employees relying on small advances for emergencies, education, or medical needs.

Meal allowance limit

The per-meal exemption for employer-provided meals is proposed to increase from Rs 50 to Rs 200. With food costs having risen sharply over the decades, the earlier limit had triggered frequent payroll disputes. The higher cap aligns the exemption with present-day urban expenses.

Festival gift exemption tripled

With rising income, more people have started spending and celebrating festivals with more enthusiasm. To promote this spending behaviour, the annual tax-free exemption for gifts and vouchers is set to increase from Rs 5,000 to Rs 15,000

Higher transport allowance cap

For employees working in transport systems such as railways, airlines and shipping, the exemption cap is proposed to increase from Rs 10,000 per month to Rs 25,000 per month, while retaining the 70 percent allowance rule. This would provide the employees working in the transport systems, eligibility to claim a higher tax-free transport allowance, thereby reducing overall tax liability.

Mandatory Quoting of PAN Card

The draft Income Tax Rules 2026 also propose changes to the limits of several transactions where PAN Card number needs to be quoted. For example, presently if you deposit cash above Rs 50,000 in a day, you need to quote your PAN Card. Under the new rules, PAN Card will be mandatory for cash deposit of Rs 10 lakh in a financial year. Similarly, cash withdrawal from a banking company or post office of more than Rs 10 lakh in a financial year will now require a PAN Card, if draft rules are approved.

Foreign Tax Credit (FTC) Compliance

To claim foreign tax credit, taxpayers currently submit Form 67. Under the Draft Rules, Form 67 is replaced by Form 44. If the foreign taxes paid are Rs 1,00,000 or more, Form 44 must be verified by an accountant. This adds an additional layer of verification for higher foreign tax credits.

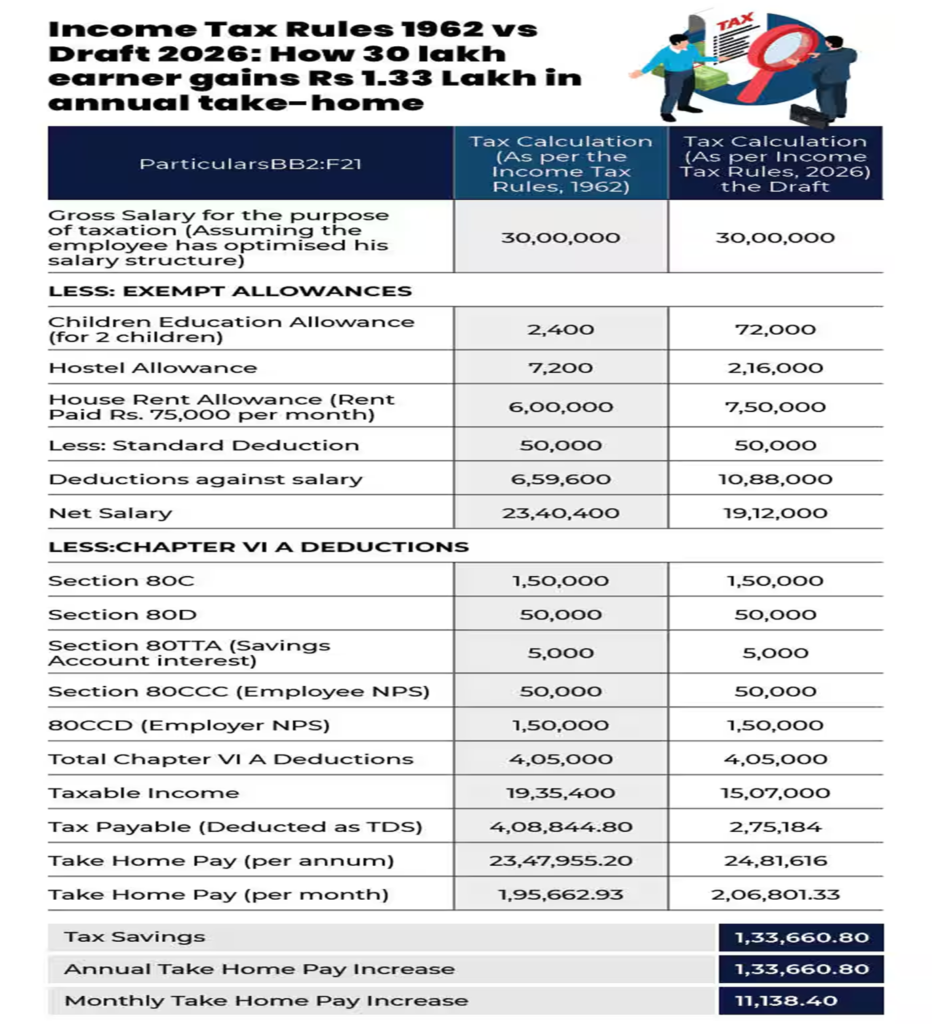

Let us understand with an example how the new rules will impact your salary

Suppose Ramesh earns a gross salary of Rs 30 lakh a year under the Income Tax Rules, 1962, after factoring in exempt allowances such as Rs 2,400 for children education allowance, Rs 7,200 for hostel allowance, Rs 6 lakh as HRA (with Rs 75,000 monthly rent), and a standard deduction of Rs 50,000, his total deductions work out to Rs 6,59,600, leaving a net salary of Rs 23,40,400.

After claiming Rs 4,05,000 under Chapter VI-A (including Sections 80C, 80D, 80TTA, 80CCC and 80CCD), his taxable income is Rs 19,35,400, and the tax payable is Rs 4,08,844.80. This leaves him with an annual take-home pay of Rs 23,47,955.20 (Rs 1,95,662.93 per month).

Under the draft Income Tax Rules, 2026, however, higher exempt allowances, Rs 72,000 for children education, Rs 2,16,000 for hostel allowance and Rs 7,50,000 for HRA, raise total salary deductions to Rs 10,88,000, reducing taxable income to Rs 15,07,000.

With tax payable falling to Rs 2,75,184, Ramesh saves Rs 1,33,660.80 in tax annually. As a result, his annual take-home pay increases to Rs 24,81,616 (Rs 2,06,801.33 per month), reflecting a monthly gain of Rs 11,138.40 under the new rules.

Accordingly, under the Income Tax Act, 1962, the tax liability works out to Rs 4,08,845. Under the draft Income Tax Rules, 2026, it reduces to Rs 2,75,184. This is also lower than the tax payable under the New Tax Regime, which comes to Rs 4,75,800 even after claiming exemptions for children, education and house rent allowances.

Leave a comment