Editor – Ananth Suresh

Why Markets Feel More Volatile Today

January 2026 marked two policy developments that has materially increased geopolitical and economic uncertainty. On January 3, 2026, it was reported that U.S. forces had captured Venezuelan President Nicolás Maduro. Another shocking news that emerged was the fact that United States would oversee Venezuela during a transition period and that they would have control over Venezuela’s oil reserves.

These actions were particularly more relevant as Venezuela reportedly has 303 billion barrels of crude oil proven reserves out of which 1% remain untapped due to poor infrastructure. Further news reports on January 10 have revealed that US oil industry executives were being assured and supported by the US President to extract oil in Venezuela. Additionally, 5 oil tankers have been seized by US, with allegations of trafficking and shipments to Russia being a justification so far while there has been a control over distribution networks.

On January 5, the US President issued threats with respect to further increasing tariffs while reiterating that several Indian exports already face 50% tariffs. This threat was materialised on January 7 with the advancement of a Russia Sanctions bill in the US Congress which will let them charge tariffs of up to 500% on countries that purchase Russian energy such as China, India, and Brazil. This has not been enacted as of now but the consequences of such actions are crucial and will lead to volatility in crude oil prices that will ultimately affect global economy and cause uncertainty around global value chains, export competitiveness, exchange rates, and capital allocation decisions.

While these policy actions seem very extreme, if history is to be quoted, it can be understood that such instances have happened in the past with powerful states or blocs unilaterally using coercive policies to benefit their own economies. Colonialism is a proven example of this.

Historical Patterns Across Time

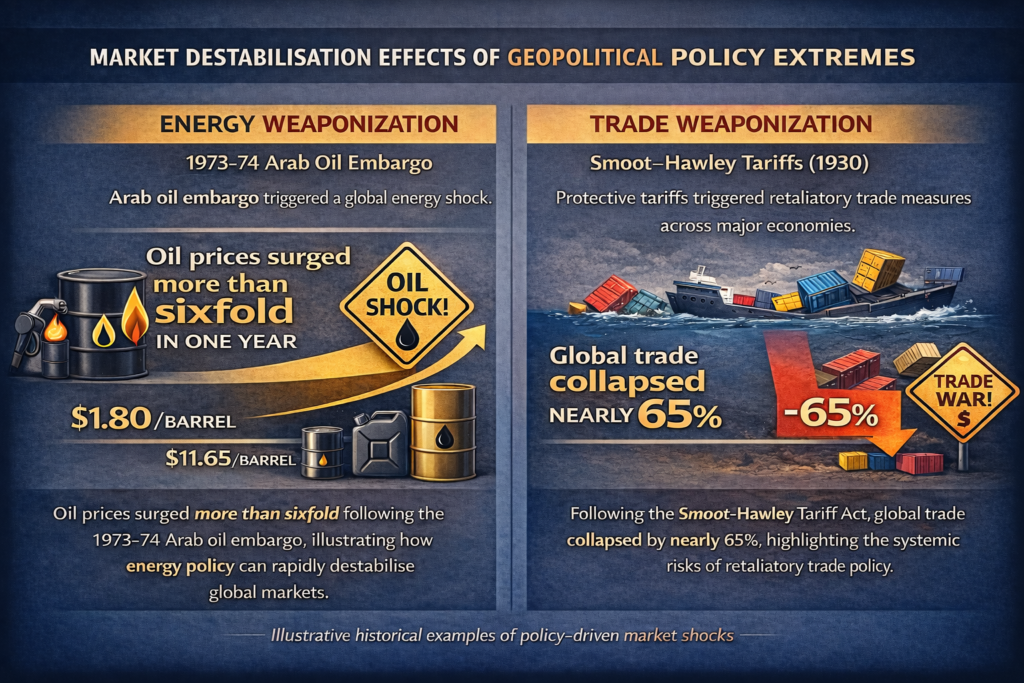

A trade policy that has yielded negative results was the Smoot-Hawley Tariff Act of 1930. While the world was recovering post-World War 1, European farmers had started overproducing which led to decrease in agricultural prices. American agricultural bodies wanted protection and requested their President to impose import duties on agricultural products. The US decided to increase duties by 20% on 20,000 goods which included non-agricultural products as well. This led to European counterparts to impose similar duties on American exports. Considering that this happened during the Great Depression, its effects were magnified. A few observers have also stated that not only has this policy created economic uncertainty, but from a geopolitical context it has promoted isolationism which could have factored into rise of political extremists like Adolf Hitler.

In 1973-74, Arab countries imposed an oil embargo on US and several other countries for supporting Israel in the Yom Kippur war. This embargo led to a price increase from $1.8 per barrel to a staggering $11.65 per barrel by OPEC. This was an instance which showed how energy can be weaponised to create global macroeconomic instability.

Another example is of how China imposed export quotas and tariffs on rare earth elements exported to Japan in 2010. The cause for this was initially diplomatic, a Chinese fishing boat had been seized by Japan, and the quotas were in retaliation to this. China relented from dropping the tariffs even after Japan released the trawler leading to rise in prices of rare earth elements globally, which also affected Japan’s output. This ultimately led to a dispute being filed with the World Trade Organisation. The Dispute Settlement Board was informed by China that the export tariffs and quotas were to prevent over-mining and prevent pollution. The board in 2014 ruled that China’s policies had violated WTO agreements and China abolished the quotas and tariffs in 2015.

Conclusion

Working through these historical examples have clearly helped to identify that the 500% tariff threat and control over Venezuela’s oil reserves are not isolated anomalies but instead is part of a recurring pattern of extreme policies that disturb predictable systems and frameworks into volatile markets which display uncertainty in energy prices, currency fluctuations, and trade flows. It should also be noted that outcomes of such policies are rarely endemic or just between two nations and end up spilling over to the global economy. It can therefore be stated that policy predictability is an economic asset and that deviation towards policy extremes often lead global economic problems.

Leave a comment