Editor – Srikanth Kumar

The famous saying “The only constant in the world is change” may not be as true as it might sound. For more than 400 years, financial markets have changed drastically, yet the only constant is human behaviour. From the Tulip Mania of 1637 to the Dot-com boom, Bitcoin 2017/2021 and todays’ micro-frenzy has followed the same pattern of humans being driven by beliefs, emotions and crowd following psychology. Learning and understanding our behaviour has proven to be more important than predicting market behaviour today.

What is a Bubble?

An asset bubble occurs when prices rise far above intrinsic value, fuelled by speculation and enthusiasm rather than fundamentals. The result is unsustainable pricing, typically ending in a sharp correction. There’s no universally agreed definition for bubbles, but speculative demand, psychological drivers and amplifiers are markers of the phenomenon. Valuation parameters can help to spot a bubble, but a psychological diagnosis is essential. Bubbles reflect irrational exuberance, putting companies on a pedestal, fear of missing out and in many cases a belief that there is no price too high.

FOMO – The Emotional Fuel of Bubbles

FOMO or the fear of missing out has come to be the psychological engine of every bubble. Jealousy and fear have proven be a better fuel than we ever thought it to be. When early investors make huge gains, the crowd panics, not from fear of loss, but fear of not becoming rich like everyone else. Now, lets talk about some triggers of FOMO:

- Viral success stories like “My friend made 10x in one month!” and “My next few days of expenses have been accounted for” lead to more herding.

- Media hype and social media narratives create buzz, glorify things and often portrays the beautiful side of things.

- Influencers claiming, “This is the future”.

- Price charts that go straight up triggers the greed in people who fail to realise that the same chart could be showing an inverse trend too.

FOMO makes investors more susceptible to ignoring the fundamentals, taking massive risks via leverage and believing “this time is different” when it’s not.

The Herd Behaviour

The human consciousness is built to ensure its own survival, adding to this the fact that we are social animals too, we tend to form groups. In markets, this becomes dangerous. People assume that “If everyone is buying, they must know something I don’t” due to which they copy others blindly, thus reinforcing the bubble which in turn creates a positive feedback loop: Prices rise → more people rush in → prices rise even faster → confidence increases → the herd grows. This cycle continues until reality breaks it, which we call the famous “reality check”.

5-Stage Model of Bubble Forming and Bursting

Stage 1: Displacement – A new theme appears, like a new technology, an asset class or a policy change. Some examples can be the Internet in 1999, Bitcoin in 2008 and AI small cap stocks in 2023-24.

Stage 2: Boom – Early adopters make huge returns. Media attention begins. Retail enters slowly.

Stage 3: Euphoria – People develop a blind belief that the asset could never fail, valuations disconnect from reality, leverage surges and new investors enter daily.

Stage 4: Profit-Taking – It is in this stage that smart people quietly exit the market playing the retail investors for a fool.

Stage 5: Panic & Crash – A small negative event triggers fear, which in turn leads to prices falling, investors panicking, which in turn accelerates selling until collapse. Narratives suddenly reverse from “This will change the world” to “It was always worthless”.

The Psychology

The stages show that bubbles aren’t just about excess liquidity, they involve collective biases brought out by seductive narratives:

- Overconfidence: Investors overrate their forecasting ability, attributing gains to skill.

- Extrapolation: Rising prices are seen as evidence of a permanent trend.

- Herding: Fear of missing out outweighs fear of losses; social proof is powerful.

- Availability: Recent gains overshadow long-term risks.

- Confirmation bias:Information is sought that supports a bullish stance and dismisses contrary views.

- Greater-fool theory: Belief that there will be buyers at any price, regardless of intrinsic value.

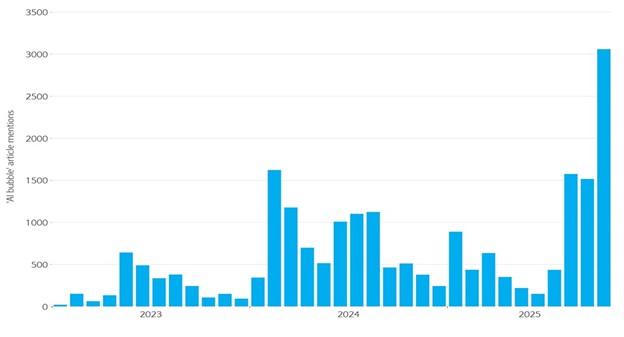

Are We in an AI Bubble Today?

AI’s explosive rise mirrors past innovation-led bubbles, raising familiar concerns. The Magnificent 7 alone drove over 20% of global equity gains in 2025 and more than 40% of S&P 500 returns, supported by increasingly rich valuations. What worries analysts most, however, is not just soaring share prices but the unprecedented surge in AI-related spending. Much like the telecom boom of the early 2000s, massive investment is being justified by a transformative technology whose long-term demand remains uncertain. Since ChatGPT’s launch in 2022, hyperscalers’ annual capex has more than doubled. Meta, Amazon, Microsoft, Alphabet and Oracle are set to lift combined capex by 64% in 2025 to over $370 billion, rising toward $500 billion in 2026. Adding to concerns is the increasingly circular nature of industry deals. Nvidia’s $100 billion investment in OpenAI tied to filling new datacentres with Nvidia chips shows the feedback loop between model developers, compute providers and chipmakers. Whether this spending is visionary or excessive remains a central question.

AI Stocks Today

AI stocks today are priced as if current leaders will dominate for decades, stretching valuations to perfection. But history shows that persistence is rare, making markets highly sensitive to even small disappointments. Recent Big Tech earnings reactions reflect how urgently investors want proof that massive AI spending will translate into near-term revenue. With GPU lifecycles barely three years, the window for returns is narrow, heightening pressure. Signs of overheating, reflexive hype loops and stretched valuations suggest the AI boom sits in a fragile middle zone between growth and bubble.

Conclusion

Financial bubbles often begin with strong narratives that slowly outgrow fundamentals, and AI is not immune to that pattern. Markets can stay irrational longer than expected, making prediction less useful than disciplined scenario-based investing. When beliefs become self-reinforcing, mispricing can spread quickly, especially in rapidly evolving technologies. Ultimately, bubbles expose human psychology more than market structure. Recognising these recurring behaviours is the surest way to stay prepared, because the next bubble is never a question of if, only when.

Leave a comment