Editor || Noopur Date

The Indian economy is heading on a critical path of its growth trajectory with strong projections of becoming the third largest economy by 2030. This aspirational growth is backed and balanced by fiscal prudence measures. The recent reforms and simplifications in the Goods and Service Tax (GST), effective from September 22, 2025, exemplify these measures.

Approved by the GST council, the reforms aim to provide relief to the common-man, boost consumption in the economy and simplify the overall tax structure. This article dives deeper into the dynamics of these next-gen GST reforms, their significance and assesses their overall impact.

GST Reforms 2025

The Goods and Service Tax (GST), introduced in 2017, subsumed several indirect taxes into a unified framework to eliminate the cascading effect. These efforts of ‘One Nation, One Tax’ were reflected in the approx 14% CAGR growth of the gross GST collections from FY 2021 to FY 2025.

However, in this period, the rate complexity, market ambiguity and compliance norm changes were some of the key challenges for the taxpayers. Therefore, along with evolving market and economic dynamics, strong policy reforms were due, to improve its efficiency.

The wait was over in the press conference of the 56th GST Council meeting on September 3, 2025, where the Finance Minister Nirmala Sitharaman announced the GST Reforms 2025. These reforms are designed mainly to streamline compliance, enhance revenue collection, and reduce ambiguity for businesses. These next-gen reforms are set to be implemented from September 22, 2025. The 7 key pillars of these reforms are as follows:

- Building on the success of GST: Expanding the taxpayer base.

- Rationalising rates for fairer taxation: A 2-tiered tax structure of 5% and 18% and a faster refund process.

- Simplifying filing through technology: Easy registration, e-invoicing compliance and 90% upfront refund for exporters.

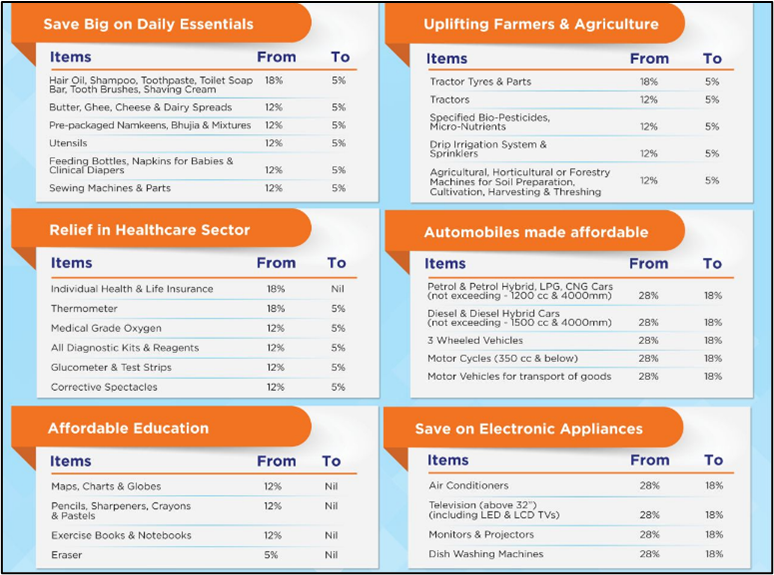

- Putting consumers first: Nearly 13%-point reduction in taxes implied on essentials.

- Empowering MSMEs & manufacturers: fixed inverted duty structure and consumption boosting push.

- Stronger states, stronger Bharat: Sustainable growth opportunity created for the businesses by lowering taxes.

- Lower taxes = Higher spending: Catalyst for private consumption, which accounts for nearly 61.4% of nominal GDP (as of FY 2025).

Key Changes Announced in GST Reforms 2025

Before the reforms, the GST slabs were 5%, 12%, 18% and 28%, which created an ambiguity in terms of charge applicability. Post reforms, the slabs will only be 5% and 18%. For instance, several crucial items of daily essentiality, healthcare and agriculture are now taxed at a lower rate of 5%. Moreover, life and health insurance premiums are totally exempted. In contrast to this, luxury and sin items like aerated drinks, tobacco, paan masala, etc., are taxed at 40%.

The rate changes and exemptions are accompanied by ease in the registration and refund process. From November 1, 2025, GST registration for small and low-risk businesses can be done in just 3 days. It can broadly benefit nearly 96% of applicants. Moreover, 90% of provisional refunds claimed by officers can be sanctioned, which can speed up the overall process.

How can GST Reforms 2025 transform the Indian business landscape?

India’s consumption-driven economy can be potentially impacted by the GST reforms 2025. On one hand, simplification of slabs and enhanced digital processes promise reduced long-term compliance costs and fewer ambiguities. On the other, the stricter ITC rules and digital scrutiny mean companies must invest in robust accounting systems and maintain higher compliance discipline. Therefore, GST reforms 2025 can:

- Promote MSME contribution (30% as of FY 23) in the total Gross Value Added (GVA).

- Increase in the overall affordability and push infrastructure.

- Boost digitalisation due to ease in process.

- Expand the taxpayer base and eventually grow GST revenue for the state and central governments.

In the current times of trade tensions and market slowdowns, these reforms have potential to catalyse the overall growth for Indian businesses.

Impact of GST Reforms 2025

After the announcement of GST Reforms 2025, most of the industry leaders and market experts hailed the efforts for long-term boost to the Indian economy. Apart from this, some echoed sentiments include greater affordability, potential ripple impact in the second half of FY 2026, timely MSME support and tax simplification. Sectors like FMCG, insurance, banks, construction, etc., are expected to benefit from these reforms in the long-term.

Market sentiment is also tapped by stock market movement. In the broader view, NIFTY 50 and Sensex saw a moderate gain of nearly 1% in the early trade on September 4, 2025. Seven of sixteen sectors climbed up with the hope of a rise in spending.

Conclusion

The GST Reforms 2025 signal a pivotal shift in India’s taxation framework. By streamlining rates, easing compliance, and enhancing affordability, they promise to empower MSMEs, stimulate consumption, and broaden the revenue base. Despite transitional hurdles, these reforms emerge as a transformative policy lever to accelerate inclusive growth and reinforce India’s aspiration of becoming the world’s third-largest economy by 2030.

Leave a comment