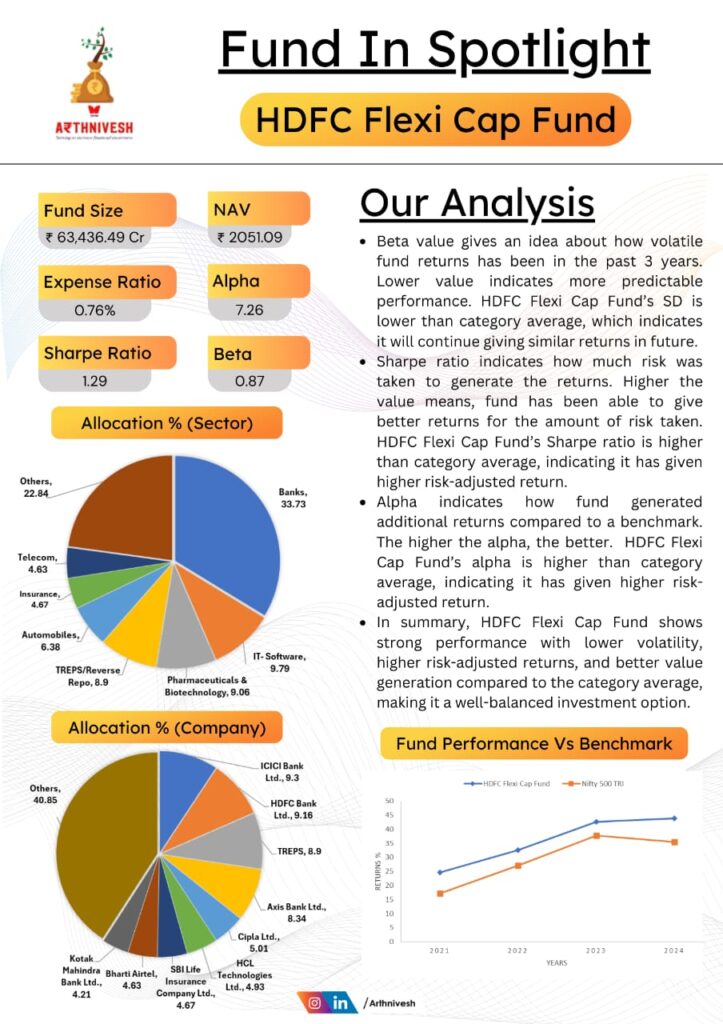

The HDFC Flexi Cap Fund stands out due to its strong performance metrics and balanced investment approach. With a fund size of ₹63,436.49 Cr and a NAV of ₹2051.09, it reflects significant investor confidence. The fund’s expense ratio of 0.76% indicates efficient cost management relative to the industry average. Key performance indicators include a beta of 0.87, suggesting lower volatility and more predictable returns compared to its peers. Additionally, the Sharpe ratio of 1.29 indicates that the fund provides higher risk-adjusted returns, meaning investors receive better compensation for the risk taken. The alpha value of 7.26 further highlights the fund’s ability to outperform its benchmark, delivering additional returns.

The sectoral allocation shows a heavy tilt toward banking (33.73%), followed by IT-Software (9.79%) and Pharmaceuticals & Biotechnology (9.06%), suggesting a diversified yet growth-focused strategy. Notable company holdings include ICICI Bank Ltd. (9.3%), HDFC Bank Ltd. (9.16%), and Axis Bank Ltd. (8.34%), with a significant portion (40.85%) allocated to other diversified assets, ensuring a balanced exposure across industries. Over the past three years, the fund has consistently outperformed the Nifty 500 TRI benchmark, reinforcing its strong performance trajectory and value creation for investors.

Leave a comment