The latest Arthneeti Newsletter delivers insights into financial terms, global economic impacts, and IPO updates. The Term of the Week covers the Lock-up Period, which refers to a fixed timeframe during which investors cannot sell their shares or withdraw their investments. This period is common in IPOs (90-180 days for insiders), investment funds (1-5 years), and real estate transactions, designed to stabilize the market and ensure long-term commitment.

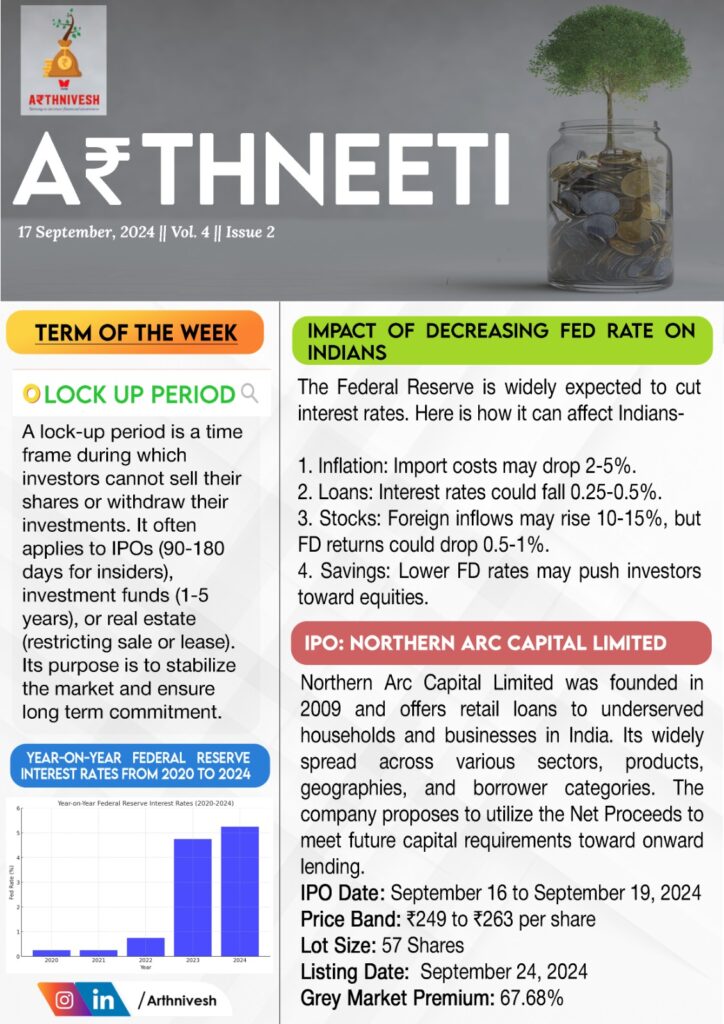

A significant section focuses on the Impact of Decreasing Federal Reserve Rates on Indians. Expected rate cuts by the Federal Reserve could lead to reduced import costs (2-5%) and lower loan interest rates (0.25-0.5%), offering relief to borrowers. While foreign investments may rise by 10-15%, fixed deposit (FD) returns could decline by 0.5-1%, prompting investors to consider equity markets.

The newsletter also highlights the IPO of Northern Arc Capital Limited, a company founded in 2009 that provides retail loans to underserved households and businesses across diverse sectors and geographies. The IPO is scheduled from September 16 to September 19, 2024, with a price band of ₹249 to ₹263 per share and a lot size of 57 shares. The company’s Grey Market Premium (GMP) stands at an impressive 67.68%, indicating strong market demand ahead of its listing on September 24, 2024.

Leave a comment