Editor – Debarauti Samui

For decades, Japanese yen has been synonymous with stability, offering investors a haven amidst the tumult of global economic and financial market turbulence. However, this reputation is now being questioned following a series of dramatic fluctuations in the currency’s value throughout 2024. As global investors grapple with the yen’s new volatility, its future role in the global financial system is under intense scrutiny.

The yen is one of the most critical currencies in the world. Within the $7.5 trillion-a-day foreign exchange market, it ranks as the third-most traded currency, behind only the U.S. dollar and the euro. Every day, transactions involving the yen exceed $1 trillion, highlighting its significance in global trade and finance.

A key reason for the yen’s heavy trading volume is Japan’s historically low interest rates. For years, the Bank of Japan (BOJ) maintained near-zero interest rates, a policy that encouraged borrowing in yen to invest in higher-yielding assets elsewhere—a practice known as the “carry trade.” This strategy has been lucrative for investors, allowing them to take advantage of Japan’s ultra-low borrowing costs.

Japan’s prolonged economic stagnation is the backdrop to this monetary policy. After experiencing rapid growth in the 1980s, Japan’s economy has been beset by a combination of deflation, rising public debt, and an aging population. These factors have suppressed economic growth for decades, prompting the BOJ to keep interest rates at rock-bottom levels to stimulate borrowing, spending, and investment.

Shift in Monetary Policy

In July 2024, the BOJ made a surprising decision to raise its interest rate to “around 0.25%” from the previous range of 0% to 0.1% set in March 2024. This marked the first significant rate hike in years and sent shockwaves through global financial markets. The immediate aftermath was dramatic: Japan’s Nikkei stock index recorded its largest single-day loss since 1987 on August 2, while the yen reversed its longstanding trend of depreciation, strengthening sharply.

This policy shift caught many market participants off guard. For years, the BOJ had been committed to maintaining ultra-low interest rates, even as other central banks around the world began tightening monetary policy to combat rising inflation. The BOJ’s sudden change in stance was a response to increasing domestic inflationary pressures. Prices and wages in Japan had begun to rise more rapidly than expected, raising concerns that inflation could spiral out of control if left unchecked.

The timing of BOJ’s decision to raise rates turned out to be spectacularly bad. Just days after the rate hike, disappointing U.S. jobs data fuelled fears that the Federal Reserve had delayed rate cuts for too long, leading to a spike in market volatility not seen since the onset of the COVID-19 pandemic. Investors, already on edge, reacted swiftly to the BOJ’s move, leading to a widespread sell-off in global markets.

The “Great Unwind”

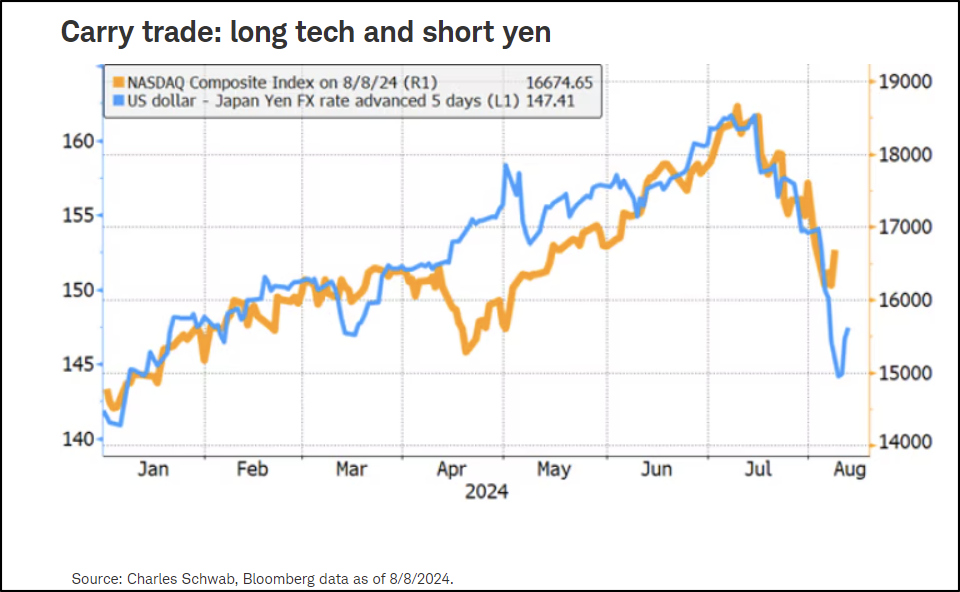

The yen’s sudden appreciation triggered what has been termed the “Great Unwind” in carry trades. Carry trades involve borrowing in a low-interest-rate currency like the yen and investing in assets that offer higher returns, such as U.S. tech stocks or corporate bonds. This strategy is profitable as long as the currency being borrowed remains stable or depreciates. However, when the Yen began to strengthen rapidly, it caught many carry trade investors off guard.

As the Yen surged in value, investors who had borrowed in Yen to fund their carry trades faced significant losses. To cover these losses, they were forced to sell off assets quickly, leading to a cascading effect in global markets. This mass liquidation of assets amplified market volatility, creating a feedback loop that further drove up the Yen’s value.

The “Great Unwind” is a stark reminder of the risks associated with carry trades, particularly in a highly interconnected global financial system. The sudden and dramatic reversal of the yen’s value illustrates how quickly market conditions can change, especially when driven by unexpected shifts in monetary policy.

The accompanying chart, depicts a trend (going long on tech and short on the yen strategy) in the dollar-yen exchange rate and the tech-focused Nasdaq, underscoring the probability that carry trades have been fuelling tech investments, though it’s likely these trades have also financed purchases in other markets.

The Impact on Japan’s Domestic Economy

While the yen’s volatility has global repercussions, its effects are also deeply felt within Japan. The country is home to the world’s largest community of retail currency traders, known colloquially as “Mrs. Watanabe” traders. These individual investors, often operating from home, have played a significant role in the currency market, leveraging Japan’s low interest rates to engage in carry trades of their own.

The stronger yen also poses challenges for Japan’s broader economy, particularly in the tourism sector. Tourism has been one of the few bright spots in Japan’s economic outlook in recent years. The weak yen made Japan an attractive destination for foreign visitors, who could take advantage of favourable exchange rates to stretch their budgets further. However, as the yen strengthens, the cost of visiting Japan would increase, potentially deterring tourists and hurting businesses that rely on international visitors.

Small- and medium-sized enterprises (SMEs) in the tourism industry, such as traditional inns and restaurants, are particularly vulnerable. These businesses, already grappling with the economic fallout from the COVID-19 pandemic, face higher borrowing costs as interest rates rose. For many, the combination of a stronger yen and rising interest rates threatened to undermine their recovery.

Conclusion: A New Chapter for the Yen and Japan

As Japan navigates these turbulent times, the yen’s status as a safe-haven currency remains in flux. The BOJ’s recent actions have highlighted the interconnectedness of global markets and the significant impact that Japan’s monetary policy can have on the rest of the world. For investors, the events of 2024 have been a stark reminder of the risks inherent in relying too heavily on historical trends and assumptions.

For Japan, the challenge lies in sustaining its nascent economic recovery while managing the risks associated with rising inflation and a stronger yen. The BOJ’s cautious approach moving forward will be crucial in determining the yen’s future trajectory and its role in global markets.

At home, Japanese citizens, from seasoned traders to small business owners, are adjusting to a new reality. The uncertainty that prevails within the country mirrors the broader uncertainty in global markets. As the world watches Japan’s next moves, one thing is clear: the Yen’s journey in 2024 has marked the beginning of a new chapter, both for Japan and for the global economy.

Leave a comment