Editor – Anshul Chourasia

War finance, a complex matrix of economic tactics interwoven into the framework of military campaigns, has been instrumental in charting the trajectory of nations across history. As a crucial component of defense economics, it undergirds the economic foundation that bolsters a military’s strength. The triumph of a war hinges not merely on strategic victories but also on the economic resilience and prowess of the involved state. This article explores the diverse facets of war finance, traversing from ancient civilizations to contemporary conflicts, unraveling the complexities of war funding and its ensuing economic repercussions.

From the chronicles of antiquity to the modern era, conflicts and wars have invariably necessitated resource mobilization, rendering war finance an enduring aspect of military strategy. A case in point is the Roman Empire, where the relentless wars with Carthage pushed the economy to the brink of financial collapse. The primarily agrarian Roman economy grappled with the colossal burden of military expenses, prompting innovative albeit ephemeral solutions like currency debasement. Pillage and plunder, integral to war economies, have been significant across epochs, with conquering forces extracting resources from vanquished territories.

War finance mechanisms can be broadly segregated into three primary categories, each bearing economic implications:

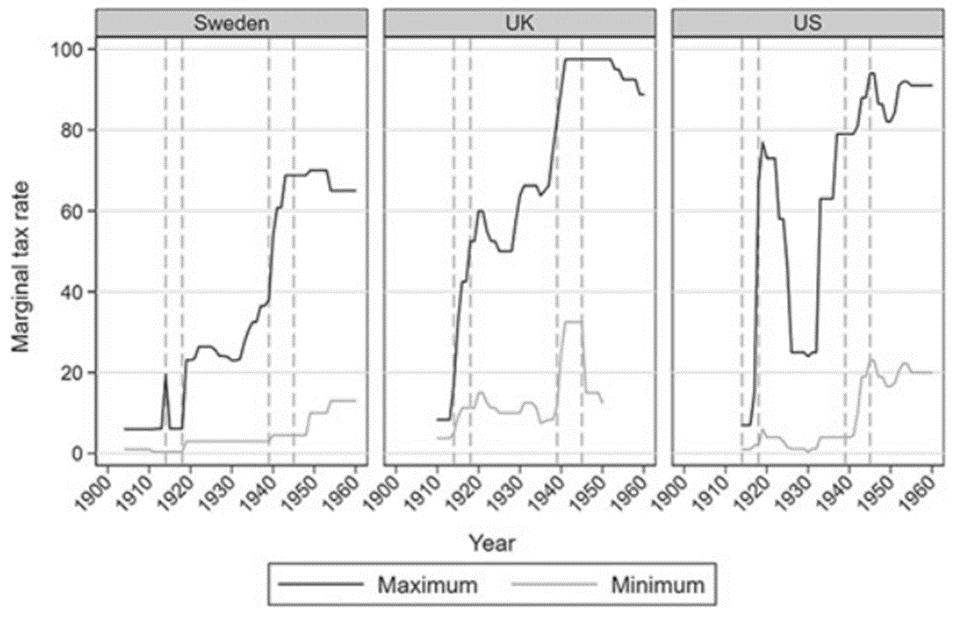

First is Taxation, a politically sensitive method of financing wars, directly engages the citizenry in funding military operations. During World War I, the United States and Great Britain financed a quarter of their war expenses through escalated taxation, while Austria made no contribution via taxation. The income tax in Britain witnessed a steep rise from 5.8% in 1913 to over 30% within five years, expanding the tax base to encompass more individuals.

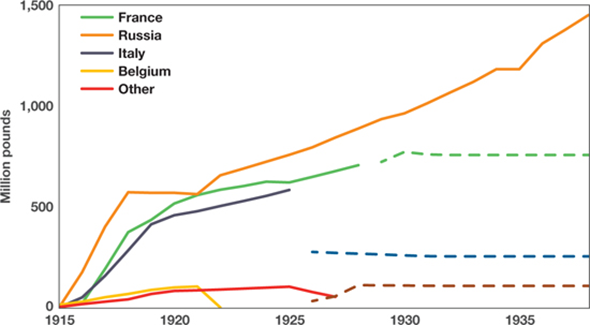

Second is borrowing, Governments frequently resort to borrowing for war finance, particularly when they foresee short-term conflicts. The onset of World War I, initially envisaged as a brief conflict, prompted nations to borrow extensively to meet extraordinary financial demands. Government-issued bonds, often purchased by central banks or other lenders, facilitate the deferral of sacrifices to future generations. The economic consequences encompass wealth redistribution through interest payments and potential impacts on a country’s capacity to repay its mounting debt.

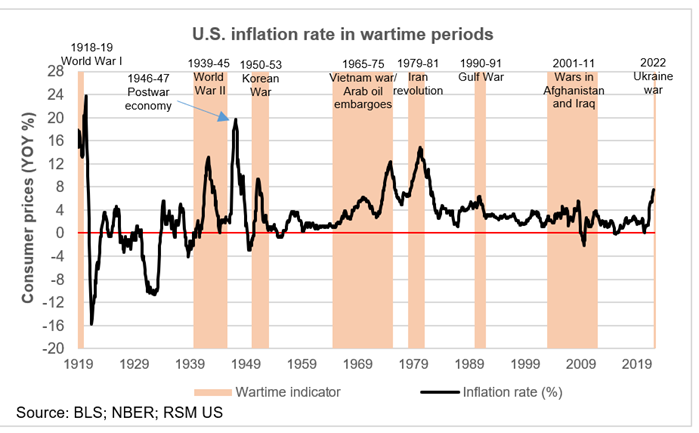

Last resort printing more currency- Governments may opt to expand the money supply to fund war efforts, a monetary strategy that can trigger inflation. While this offers immediate financial aid, it diminishes the population’s purchasing power, functioning akin to a form of taxation. The arbitrary allocation of war costs, particularly impacting those with fixed incomes, can reverberate on a country’s production levels. During World War I, nations, including Britain and Germany, relinquished the gold standard and inflated their currencies by issuing more banknotes.

The choice between borrowing and taxing carries profound political ramifications. Taxation, though a direct and immediate means of financing wars, often encounters public opposition. Borrowing, conversely, offers a more politically palatable alternative, as its repercussions are deferred and may be transferred to future administrations. Wartime borrowing is perceived as politically beneficial, mitigating the immediate electoral consequences for leaders. The United States, confronted with the threat of government shutdowns, consistently chooses to raise the debt ceiling, underscoring the political feasibility of borrowing.

A closer look at the wars in Afghanistan (2001) and Iraq (2003) underscores the hesitance of politicians to levy war taxes, particularly when the rationale for war is publicly scrutinized. Borrowing emerged as the preferred financial strategy, as evidenced by the Bush administration’s initial projection of $50 billion to $60 billion for the Iraq war. However, as the complexities of the conflict unraveled, this estimate was revealed to be a gross miscalculation. By 2006, economists Linda Bilmes and Joseph Stiglitz pegged the actual cost at over one trillion dollars. Further analyses, taking into account macroeconomic costs, estimated the cumulative cost of the Afghanistan and Iraq wars to be at least $4 trillion, with the potential for further escalation.

War finance, an enduring aspect of conflicts, has left indelible imprints on the annals of history, shaping the destinies of nations and molding economic landscapes. From ancient civilizations wrestling with financial constraints to contemporary governments navigating the intricacies of borrowing and taxation, the economic repercussions of war finance reverberate through time. The decisions made in financing wars, whether through taxation, borrowing, or inflation, carry far-reaching implications, affecting not just the immediate conflict but also the future economic health of nations. A closer examination of the tapestry of war finance reveals that the economic dynamics of war are as multifaceted and complex as the conflicts themselves.

References

https://academic.oup.com/ereh/article/26/3/311/6381511?login=false

https://www.elibrary.imf.org/display/book/9781513511795/ch002.xml

Leave a comment