Well over the past few months, India has been seeding roots in various trades across the world. Be it strengthening old alliances or building new connections. From the UK-launched healthcare alliance to the enrichment of ties between Vietnam and the UAE, the list goes on. One thing is certain this time, is the backing of our beloved currency the Indian Ruppe.

India’s policymakers have made significant changes in positioning the rupee across the global landscape. One most recent would be the memorandum of understanding signed between the UAE and India stating the usage of local currencies for cross-border transactions and another MoU was signed about the integration of the countries payment systems. India has also made notable progress in initiating trade in INR with its neighbours Nepal, Bhutan, Bangladesh and Sri Lanka and even the banks of Russia.

With the current turmoil in the global markets, the almighty US dollar certainly looks to still reign its supremacy in the global monetary system even though recent reports stating an upcoming recession could sweep in. With India’s strong financial prowess, it seems likely that the Indian Rupee can see new heights on the global pedestal, but will that prove to be a boom for the Indian economy? or are we digging our graves?

Historical perspective:

India’s involvement in bilateral alliances can be traced back to the period following its independence. In the early years, India’s foreign policy was focused on non-alignment and self-sufficiency, reflecting a desire to maintain a balanced stance in international affairs. However, with the advent of economic liberalization in the early 1990s, India began to shift its focus towards increased economic engagement and active participation in the global arena. This shift in policy led to a greater emphasis on bilateral alliances, as India sought to forge closer ties with key partners to promote its economic and strategic interests.

Since then, India has entered into a wide range of bilateral and regional trade agreements, including free trade agreements (FTAs), comprehensive economic cooperation agreements (CECAs), and preferential trade agreements (PTAs).

Comprehensive Economic Cooperation Agreement (CECA) with Singapore: This agreement was signed in 2005 and came into effect in 2009.

India-Japan Economic Partnership Agreement (JEEPA): This agreement was signed in 2007 and came into effect in 2011.

ASEAN-India Free Trade Area (AIFTA): This agreement was signed in 2003 and came into effect in 2009.

India has been working towards the internationalization of the rupee for several years. In 2013, the Reserve Bank of India (RBI) allowed foreign investors to hold rupee-denominated bonds, known as masala bonds. This made it easier for foreign investors to buy and sell such assets in India. In 2015, the RBI further liberalized the market by allowing foreign investors to trade in rupee-denominated derivatives. And in 2019, the Indian government began a process of liberalizing the exchange rate, making the rupee more attractive as a reserve currency.

The Internationalisation of the Indian Rupee:

For starters, the RBI has taken steps to allow for Special Vostro Rupee Accounts (SVRA’s) for settling payments in the Indian rupee. In simple terms, SVRAs are accounts that are held by a foreign bank in India. These allow for easier transactions to facilitate imports and exports, improve settlement time & enhanced transparency. Now since it has such a major influence on foreign trade. It also bears some weight in controlling currency fluctuations. Having established about 18 SVRA’s for Fiji, Germany, Guyana, Israel, Kenya, Malaysia, Mauritius, Myanmar, New Zealand, Oman, Russia, Seychelles, Singapore, Sri Lanka, Tanzania, Uganda, Russia and the United Kingdom.

Now some may ask, why does India want the rupee to go global, won’t that only strengthen the rupee which will be beneficial in the short run, however, can have adverse implications in the long run.

Why Internationalising is necessary?

The US is bound to speculation on recession, so much so that Michael Burry famous for “The Big Short” put up a bet of 1.6 Billion against the US market, taking a bearish stance. As the saying goes the US sneeze’s the globe catches a cold. Well, internationalising the rupee is creating a well-protective mask to withstand the flu. The US or to be more specific the USD makes up over 88% of the total volume traded in the world’s foreign currency markets, followed by the Euro, Japanese Yen, and British Pound. Only 1.7% of the total is in Indian rupees.

Such dependency on the USD will only hinder the growth of the rupee. Focusing on trade linkages can increase the bargaining power and reduce currency risk for a large portion of Indian businesses by keeping the volatility of currency in place. Such control can also muster a competitive advantage for local businesses.

Most recently, the Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles launched the Foreign Trade Policy (FTP) 2023. As per the policy, the government aims to touch 2 Trillion in exports, Digitisation and faster processing, Amnesty schemes and over 50% reduction in the threshold for recognition of star trade houses along with the restructuring of schemes. With all this in place, can the rupee even make a comeback? observing the trends, it’s quite surprising to see the state of the Indian rupee over the past few years.

Alarming Shifts in Currency:

To give a better idea of the currency shifts the below table depicts the trends over the past ten years. Although it may seem alarming that at such a sensitive stage when the global economy is set on the edge, tipping on either end of the spectrum.

In the past year,

RBI Intervention will keep maximizing the efforts to keep the rupee in a tight range. Predictions for the upcoming three-month period spanned from 80.67/dollar to 83.80/dollar, a margin only slightly broader than the range of 80.88 to 82.95 observed thus far in the current year. The decline was also experienced by other Asian currencies, which also encountered difficulties due to a risk-averse sentiment triggered by the credit rating downgrade of the U.S. by the rating agency Fitch. Trade plays a crucial part in the global currency markets. Mentioned below are a few known trade partners, however, recent standings can pose a dilemma to the Indian Rupee.

India’s peculiar trading partners:

Now to understand where India stands on the global forefront,

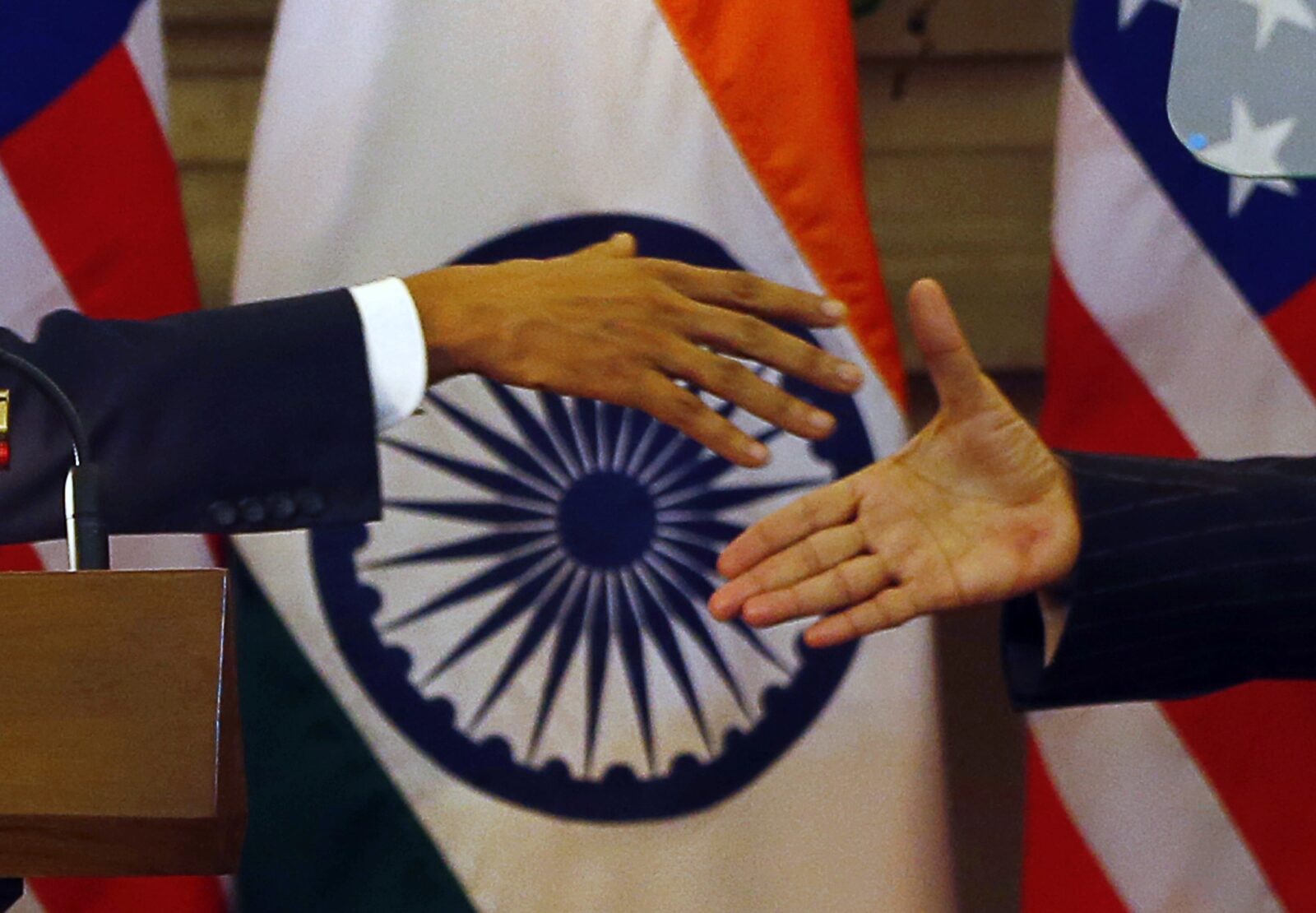

India with the US:

Boosted by growing economic connections, the United States became India’s top trading partner in 2022-23. The trade between the two countries rose by 7.65% to $128.55 billion, up from $119.5 billion in 2021-22, while imports grew by about 16% to 50 billion. The major items of trade include petroleum, polished diamonds, pharmaceutical products, jewellery, light oils and petroleum, frozen shrimp etc.

However, Petroleum, raw diamonds, liquefied natural gas, gold, coal, garbage and scrap, almonds, etc. are major imports from the United States.

If India, wants to join the motion of de-dollarization, then this is a definitive factor that puts a hold on that fruitful vision.

Balance of trade refers to the difference between a country’s export value and import value for a given period. India although showing highly positive signs in growth and stability, still compares quite a slump to the likes of Giants like the US. One major observation is to understand the trade surplus, being a goods surplus or a service surplus. Both have different observations as a service surplus would boost the economy of the country using the services.

India with the UAE:

Over recent years, the middle east has instilled investments far and wide, and India stands tall in such matters. De-dollarization is particularly important because the UAE is India’s second-largest supplier of LPG and LNG and its fourth-largest supplier of crude oil. In the most recent news, a significant milestone was achieved as Adnoc and the Indian Oil Corporation conducted the inaugural crude oil transaction using the local currency settlement (LCS) system.

The Indian embassy in the UAE confirmed this pivotal moment, highlighting that the transaction involved the sale of approximately one million barrels of crude oil. Notably, Indian rupees and dirhams were utilized in this groundbreaking transaction. Its effect is still to be witnessed in the currency markets.

To put it into perspective, the above draw out a map of the year preceding. Stating the growth and influence UAE has grown over the years. Although the UAE may seem to be a strategic partner dealing in the local currency, its ties with China-based imports can also have a substantial effect based on the comparison of the rupee to the Chinese Yuan.

This can be observed with the trade that took place with Russia aligning the same site of potential events can take place depending on the reserves and trade efficiency which can be better understood by taking a look at Prof Vijay Victor’s article –“ Rupee must catch up with Yuan before replacing $- https://www.deccanherald.com/opinion/rupee-must-catch-up-with-yuan-before-replacing-2646279

Another observation is the country that ranks third in India’s exports mentioned – the Netherlands.

India with the Netherlands:

A known fact, the Netherlands emerged as India’s third-largest export destination. The trade surplus with the Dutch has also shown an uptrend to 13 billion from 8 billion. Due to its efficient port & hub connectivity due to which an increase in the shipping of goods like petroleum products, electronics, chemicals, and aluminium products. Everything sounds great until news broke out yesterday that

In the second quarter of 2023, the economy in the Netherlands shrank by -0.3%, showing a decline from the previous three months. This has led to what’s called a “technical recession,” which means the country’s economy is struggling due to two consecutive contractions in a row. The main reasons for this downturn were less spending within the country and reduced trade with other nations.

Now although, the Netherlands is a major export destination. The same cannot be said from the perspective of the Netherlands whose import composition does not share a major composition with India. So who is at a loss here, if the Dutch chose to shun down on imports or increase exports to recover?

India with China:

And lastly a crucial player, competitor and a friendly foe. Who has been India’s top trading partner but has also been the cause of the widening of the trade deficit? China has been a fierce competitor not only on the manufacturing and technology forefront from beating Tesla in EV sales to being the world’s factory.

China has not withheld its intentions to internationalize the Yuan as well. As it also seeks to de-throne the US dollar. One major entity that creates a mutual dependency is Russia after being sanctioned due to the War have been settling more trade in Yuan which has also become Russia’s reserve currency.

However, India is still behind in the race it holds a better chance with the prospect of a Global democratic image, where China’s democratic behaviour and ties in the global supply chain during the pandemic have raised eyebrows across the globe. The Chinese have continued the effort being a country that has a high level of resources and investments in a large number of countries including the US.

If we compare the currency trends, we can see that both nations still don’t show any substantial promise to be the dominant currency of the globe yet. The parallel phases don’t seem to coincide as higher volatility can be noticed in the INR changes that take place. For India, upcoming corrections are expected where measures will be taken up to control the rupee from further decline, but only time will tell how global inflation can pan out across the globe.

In Conclusion:

With recent events happening around the globe, all eyes stay on the US Fed’s next move. India stands in a strong position with the advent of UPI technology being recognised and utilized for which mass users can be reached. India should act quickly in seizing this opportunity to improve and expand more Vostro accounts, indulge in policy making that brings in foreign inflows and focus on reducing the current trade deficit. All this is easier said than done, as the government has implemented steps to venture into self-sufficient schemes and initiatives.

When it comes to the US, they should understand that India’s interests sometimes differ. On the economy, India disagrees with the U.S. on trade matters, like e-commerce and duties on electronic stuff. On security, India didn’t criticize Russia for Ukraine. While the U.S. likes working with similar countries, India’s changing democracy is a concern. If the U.S. and India don’t improve their economic and security ties, it’s risky. But, focusing on each separately has limits. India is open to trading more if it gets benefits. Connecting trade and technology can lead to better teamwork and a stronger bond between India and the U.S., based on rules and actions, not just talk.

India’s exports in July 2023 were around $59.43 billion, even though there were challenges from around the world. The difference between what we sell and buy globally got better by 45.22% in July 2023, going from $15.24 billion to $8.35 billion, which is positive news. Also, the difference in goods we trade (merchandise) improved by 18.74%, being $20.67 billion in July 2023 compared to $25.44 billion in July 2022.

I didn’t ponder upon the adverse effects of a strengthening Rupee as from the current standpoint it is highly unlikely to reduce to such an extent to have substantial effects on the economy. A more call for concern is the increase that is taking place even after such remedies, schemes and plans have been put into place. The RBI has kept a watchful eye to analyse the situation and act accordingly, but it requires high priority.

But the aspiration of establishing the Rupee as a global currency remains distant. Dealing with global consequences like recession, trade barriers, insufficient inflows and excess imports can hurt the economy. Many countries within the EU have also made efforts to take over the dollar, however poor policy and bickering between nations led to democratic instability which further kept the rise of the Euro to the lands of the European nations. Many lessons can be learnt, as India is slowly gaining access to the global stage one step at a time, for instance, receiving a seat in the “Economic and Social Council” of the UN for the term 2023-25. This puts the opinions of our nation on a global standpoint and can prove to be a pedestal for the future of the economy. As we mark our 77th year of independence, we seek to grow and embrace gradual progress and a determination to rise to build international partnerships and address each challenge head-on.

References:

https://www.deccanherald.com/opinion/rupee-must-catch-up-with-yuan-before-replacing-2646279

https://www.xe.com/currencycharts/?from=USD&to=CNY

https://www.drishtiias.com/daily-updates/daily-news-editorials/rise-of-the-indian-rupee

https://www.npr.org/2023/07/24/1189268260/economy-recession-inflation-jobs-interest-rates

Review Overview

Summary

Vestibulum viverra gravida fringilla. Suspendisse accumsan purus quis augue lobortis quis sagittis

The Pros

Colors Size StyleThe Cons

Expensive Duration quality- Design2

- Speed2.5

- Saving4.5

- Features3

Leave a comment